- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Coronavirus Rampage Continues: U.S. Footwear Stocks Succumb

The coronavirus, which has been declared a pandemic, has been affecting lives and derailing economic activities across the globe. The pandemic has spread to around 146 countries, infecting more than 182,700 people. The global market is in doldrums, thanks to the outbreak. Recently, President Donald Trump declared a national emergency given the prevalent scenario.

Not just losing 80 lives so far, the United States saw its stock market suffer. While Dow Jones Industrial Average registered a decline of 12.9% on Mar 16, the NASDAQ and S&P 500 declined 12.3% and 12%, respectively. The crippling effect of the outbreak has been leading to supply-chain disruptions, slowdown in production activities and reduced demand for several commodities. In the view of implementation of safety measures and drop in store footfall, companies are temporarily shutting down their brick-and-mortar stores, curtailing work hours and operating in shifts, or permitting employees to work remotely. To top it, various companies are committed to pay for the lost shifts.

The virus has wreaked havoc on industries like Auto, Pharma, Electronics, Tourism & Aviation, Technology, Restaurants, Cosmetics, and Footwear & Apparel. Here, our focus lies on the U.S. footwear space. Per media reports, U.S. footwear imports from China dropped more than 15% year over year in January. Around 70% of the shoes sold in the United States are sourced from China. Again, suspension of the pro basketball season has further dealt a blow to the industry.

Apart from the NBA, events like the NHL, Major League Soccer, Major League Baseball (MLB), men's and women's basketball tournaments hosted by NCAA, men's ATP Tour, FIFA World Cup 2022, Spain’s La Liga and F1 Australian Grand Prix remain suspended in the wake of the intensifying coronavirus situation.

5 Footwear Players to Watch

Renowned casual footwear dealer, Crocs, Inc. (NASDAQ:CROX) , operating roughly 367 worldwide stores as of Dec 31, 2019, has decided to shut its company-operated retail stores in North America from Mar 17 to Mar 27. It operates around 165 stores across the Americas as of Dec 31, 2019. The associated employees are entitled to receive full payments and benefits during this time-off. However, the company’s e-commerce site will continue to operate. Crocs’ employees are permitted to work remotely during the aforesaid time. Management has been monitoring the situation and abiding by all local regulations.

Apart from shuttering stores in North America, Crocs’ various retail locations in Europe are also shut in response to the compliance with local regulations. However, the company’s offices and owned stores in the Greater China have re-opened. Moreover, offices in South Korea, Japan and Singapore are open. In the Asia Pacific, its company-operated stores have re-opened and store traffic has started to improve.

NIKE, Inc. (NYSE:NKE) has also announced the closure of all its company-owned stores in the United States, Canada, Western Europe, Australia and New Zealand, from Mar 16 to Mar 27. Earlier, it had announced the temporarily closure of nearly half of the company-owned stores in Greater China in response to the outbreak. It had also stated that it expects China operations to witness softness in the near term, which should have a pronounced impact on overall results.

Under Armour, Inc. (NYSE:UAA) announced the closure of all its stores in North America from March 16 through March 28, 2020. In the last earnings call, the company issued a cautionary statement that the coronavirus outbreak is likely to hurt its first-quarter 2020 sales. Given the current scenario in China, Under Armour expects first-quarter 2020 revenues to be hit by approximately $50-$60 million and consequently expects revenues to decline about 13-15% in the quarter. The company did inform that it is prepared for the possible supply chain disruptions that may develop from the material, factory and logistics perspective.

Skechers U.S.A., Inc. (NYSE:SKX) has taken a conservative approach while entering 2020. Coronavirus-stricken concerns resulted in temporary closure of both company-owned and franchise stores in China. Consequently, Skechers is witnessing a below-average traffic and comparable store sales (comps) trend. At its fourth-quarter 2019 earnings call, management cited that it may alter the guidance if the situation in China worsens, which will affect businesses outside the country and global supply chain. Further, management stated that travel restrictions due to the deadly virus and volatile consumer discretionary spending patterns are likely to affect first-quarter 2020 performance.

Steven Madden, Ltd. (NASDAQ:SHOO) has put up a soft fourth-quarter 2019 performance and has issued a cautious 2020 outlook. Adverse impact of tariffs, coronavirus, termination of the Kate Spade footwear license and higher tax rate are likely to hurt its 2020 earnings by 35 cents a share. Management further notes that the impact of these headwinds will be largely visible in first-half 2020. Steven Madden expects first-half revenues to fall mid-single digits on a percentage basis and first-half earnings per share are expected to decline roughly 25%. It envisions earnings in the band of $1.70-$1.80 per share for 2020, which suggests a year-over-year decline from $1.95 earned in 2019.

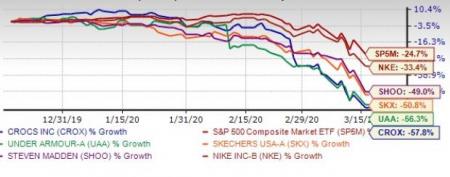

Stock Performance

Apparently, shares of Crocs, NIKE, Under Armour, Skechers and Steven Madden have tumbled 57.8%, 33.4%, 56.3% 50.8% and 49%, respectively, over the past three-months.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

NIKE, Inc. (NKE): Free Stock Analysis Report

Skechers U.S.A., Inc. (SKX): Free Stock Analysis Report

Steven Madden, Ltd. (SHOO): Free Stock Analysis Report

Crocs, Inc. (CROX): Free Stock Analysis Report

Under Armour, Inc. (UAA): Free Stock Analysis Report

Original post

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.