- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Coronavirus Rampage Continues For Skechers, Guidance Withdrawn

Skechers U.S.A., Inc. (NYSE:SKX) , provided an update on the coronavirus outbreak, stating that it is temporarily closing its company-owned retail stores across North America as well as some parts of Europe. The shutdown is scheduled to last till Mar 28. Earlier, Skechers had announced closures of company-owned and third-party stores in various gravely-impacted international markets.

In yesterday’s release, the company withdrew its recently-provided guidance for first-quarter fiscal 2020 considering the current situation and its unpredictable impact on results. During fourth-quarter earnings call, management expected net sales in the band of $1.400-$1.425 billion for first-quarter 2020. Earnings per share were envisioned in the range of 70-75 cents. However, the company has withdrawn these forecasts.

We note that rising concerns related to the COVID-19 pandemic have disrupted economic activities globally. The crippling effect of the outbreak led to supply-chain disruptions, slowdown in production activities and reduced demand for several commodities. In the view of implementation of safety measures and drop in store footfall, companies are temporarily shutting their brick-and-mortar stores, curtailing work hours and operating in shifts or permitting employees to work remotely. The deadly virus has infected more than 190,000 people worldwide and death toll has crossed 7,500.

Recently, other footwear players that closed stores due to coronavirus outbreak are Crocs, Inc. (NASDAQ:CROX) , NIKE, Inc. (NYSE:NKE) , and Under Armour, Inc. (NYSE:UAA) among others.

Coming back to Skechers, the company has been grappling with concerns related to escalating operating expenses. Also, rising selling, general and administrative expenses due to higher advertising costs might hurt the company's margin and the bottom line. In the fourth quarter of 2019, SG&A expenses rose 25.5%. Additional spending in relation to its direct-to-consumer business and company-owned Skechers stores are also bumping up costs.

Nevertheless, the company is undertaking investments to improve infrastructure worldwide, primarily e-commerce platforms and distribution centers. We believe that strength in Skechers’ e-commerce business is likely to continue, given the technology investments.

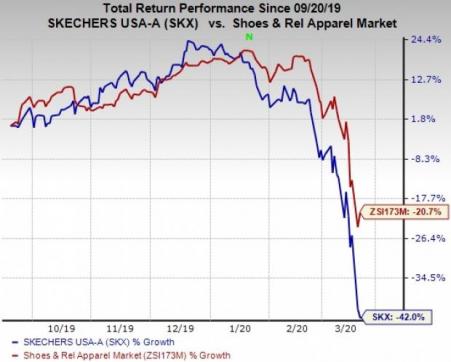

We note that shares of this Zacks Rank #3 (Neutral) company have slumped 42% in the past six months compared with the industry’s decline of 20.7%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

NIKE, Inc. (NKE): Free Stock Analysis Report

Skechers U.S.A., Inc. (SKX): Free Stock Analysis Report

Crocs, Inc. (CROX): Free Stock Analysis Report

Under Armour, Inc. (UAA): Free Stock Analysis Report

Original post

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.