- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Coronavirus May Hit United Airlines March Revenues By $1.5B

United Airlines Holdings (NASDAQ:UAL) has provided an update on how deeply coronavirus is impacting its business, as the health crisis intensifies across the globe, including the United States, forcing the state and local governments to shut down schools and restricting people to their homes. Amid this turmoil, President Donald Trump announced fresh travel restrictions to the United Kingdom and Ireland over the last weekend.

With a significant decline in travel demand as hesitant customers are avoiding air travel and following large-scale travel restrictions, the carrier transported more than one million fewer customers in just the first two weeks of March compared with the year-ago period, especially given that March is usually its busiest time of the year. As a result, the Chicago, IL-based airline expects March revenues to be down $1.5 billion year over year. In fact, the carrier anticipates the number of customers and revenues to decline sharply going forward.

To mitigate the effects of the adversities, United Airlines is planning to reduce payroll expenses. To this end, the company will be slashing corporate officers' salaries by 50%. Additionally, the airline will cut back capacity for April and May by 50%. The capacity reductions are expected to extend into the summer travel period. Despite the significant reduction in capacity, the airline expects load factor (percentage of seats filled by passengers) to fall in the 20-30% range, assuming things to worsen in the future.

In addition to significant schedule reductions, the airline previously took measures such as freezing hiring (except for crucial roles), delaying 2019 merit salary increases, and giving employees the option to apply for voluntary, unpaid leave of absence to counteract the demand slump.

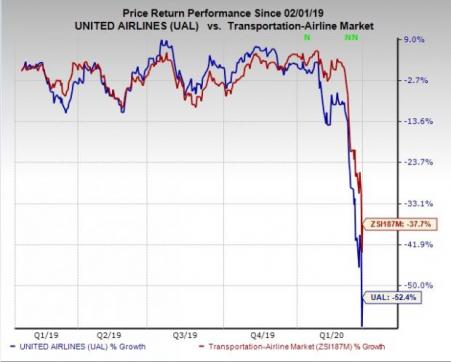

Due to setback from coronavirus-induced low demand, shares of United Airlines have plunged 52.4% since the beginning of February compared with the industry’s 37.7% decline.

Zacks Rank & Key Picks

United Airlines currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader Transportation sector are Azul (NYSE:AZUL) , Ryanair Holdings (NASDAQ:RYAAY) and GATX Corporation (NYSE:GATX) . While Azul and GATX sport a Zacks Rank #1 (Strong Buy), Ryanair carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Each of the stocks has an impressive earnings history. Azul’s earnings surpassed estimates in the preceding four quarters, with the average being 209%. Ryanair trumped the Zacks Consensus Estimate in three of the last four quarters and missed the same once, with the average positive surprise being 56.3%. GATX’s earnings also outperformed the Zacks Consensus Estimate in each of the trailing four quarters, with an average of 21%.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Ryanair Holdings PLC (RYAAY): Free Stock Analysis Report

United Airlines Holdings Inc (UAL): Free Stock Analysis Report

GATX Corporation (GATX): Free Stock Analysis Report

AZUL SA (AZUL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.