The most recent release of the Conference Board's consumer confidence index showed a steep decline not only in current sentiment but also in future expectations. Econoday summed it up well:

"The consumer confidence report shows hard evidence that the fiscal cliff is hurting the consumer's assessment of economic conditions. The index fell 6.4 points this month to 65.1 with weakness centered in the post-cliff outlook, that is the expectations component which plunged nearly 15 points to 66.5. The assessment of the present situation actually is up, rising nearly 5-1/2 points to 62.8 which is by far the best reading of the recovery!

And the assessment of the current jobs market is a highlight of the report with only 35.6 percent describing jobs as hard to get which is down sizably, nearly two percentage points from the prior month. More also describe current business conditions as good and fewer describe conditions as bad.

But what is bad is the outlook six months out where fewer see jobs rising and many more see jobs falling. More also see a decrease in their income ahead, at 18.7 percent vs November's 15.6 percent which is a big jump for this reading that underscores the fiscal cliff effect."

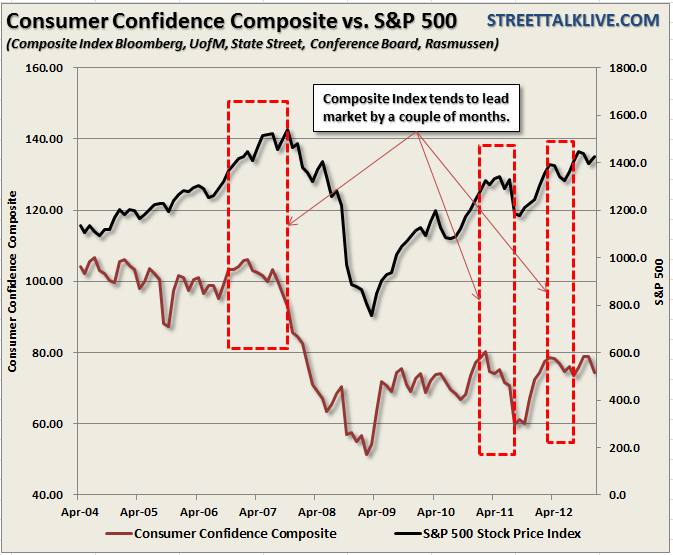

However, it is not just the Conference Board's measure of consumer confidence that has turned down as of late. The chart below is a composite index of consumer and investor sentiment including Rasmussen, Bloomberg, State Street, and the University of Michigan polls along with the Conference Board's current and future expectations indexes.

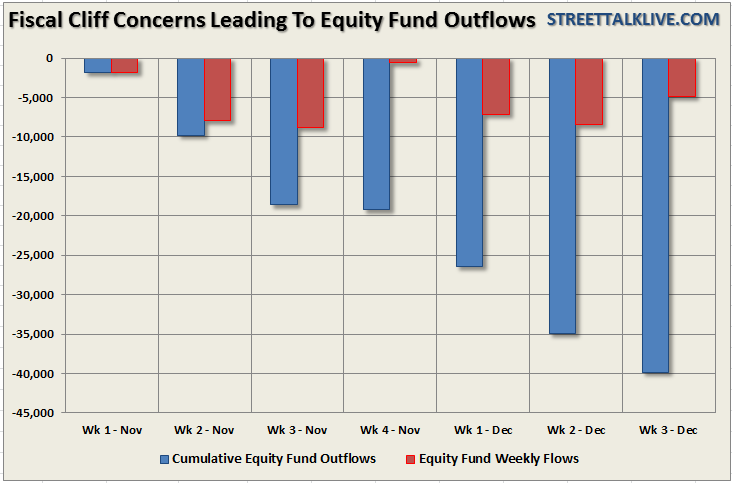

What is clearly evident is that the impact of the worries over the fiscal cliff is weighing not only on the consumer sentiment but investor sentiment as well. This lack of conviction, despite the continued drumbeat from analysts calling for new market highs in 2013, has led to continued withdrawals from equity based mutual funds in recent weeks totaling in excess of $39 billion since the election.

The question that remains is whether a resolution to the "fiscal cliff", in whatever form, will draw individual investors back into equity funds in the months to come? The drive for income, regardless of the inherent risks, has kept money flowing steadily into the fixed income funds, driving prices higher and yields lower, even while the media, and analysts, have continually warned of a debt bubble. These warnings have not deterred investors who continue to opt for yield, and perceived safety, over capital appreciation.

The fears of hyperinflation due to QE programs from the Fed, economic collapse from Government debt loads and global concerns from the Eurozone, while all generally misplaced, continue to drive the "fear trade." This has led to a chase for gold, guns and yield.

The inherent problem is that we have seen yield chases before which have all ended in disaster as with the "Nifty Fifty" in late 70's. However, as with all things market related, the insanity can last far longer than most can imagine. Of course, this why investors continue to get swept from one bubble to the next (technology, housing and now - high yield bonds) each time believing that they will be smart enough to get out early. Unfortunately, they never are.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Consumer Confidence Composite Turns Down

Published 12/28/2012, 12:33 AM

Updated 02/15/2024, 03:10 AM

Consumer Confidence Composite Turns Down

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.