Commodities received a strong boost on Monday on increased worries that the Ukraine crisis could trigger an armed conflict in the Black Sea region. Commodities went the opposite way of falling stocks as the risk of supply disruptions rose while while gold was sought as an insurance policy. While the immediate threat of an armed conflict in Ukraine has eased, the war of words will most likely continue for the foreseeable future. This has not been enough to support a continued rally and as a result, the slowing short-term momentum seen over the past week continues.

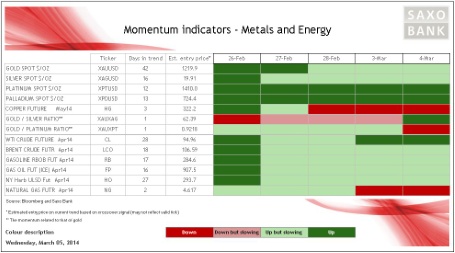

The metal sector has seen negative momentum in copper following the recent deterioration of Chinese economic data and the XAUXPT ratio with platinum outperforming on worries that inventories from the strike-hit South Africa are beginning to run low. This has ensured continued support for platinum while potential sanctions against Russia has given palladium a technical boost resulting in the downtrend from February being broken.

Both gold and silver momentum have been slowing over the past few days despite the short-lived spike on Monday. Gold is outperforming with the XAUXAG ratio turning positive with gold having received the bulk of demand from hedge funds and safe haven buyers recently. The very rapid increase in hedge funds' net-long positioning over the past few weeks currently poses the biggest risk to gold as only a moderate weakness from present levels would leave many recently established positions in the red.

The energy sector has begun to slow as the US slowly begin to move out of the deep freezer towards spring and milder weather. The very cold winter over the past couple of months has been one of the key drivers and as demand from refineries begin to soften the availability of crude oil will rise. WTI remain relatively better supported than Brent crude as long supplies at Cushing, the delivery hub for WTI crude futures, continue to shrink. Today's weekly inventory report is expected to show another drop in Cushing inventories and this has helped to shrink WTI crude's discount to Brent crude to just USD 5.5/barrel — the lowest since last October. Natural gas, which saw amazing volatility in the past month, has begun to stabilise and momentum has turned negative for the first time in two months.