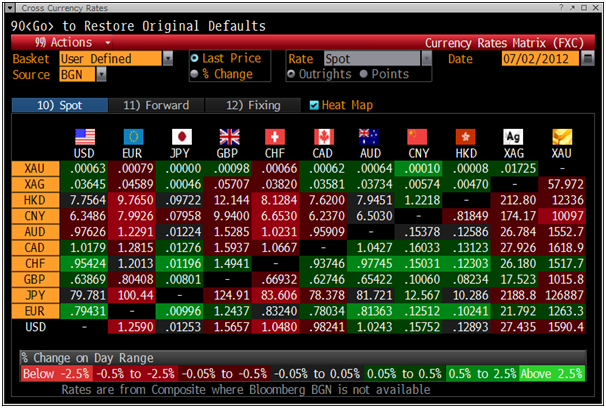

Today's AM fix was USD 1,596.25, EUR 1,263.26, and GBP 1,018.34 per ounce.

Friday’s AM fix was USD 1,569.50, EUR 1,248.01, and GBP 1,006.09 per ounce.

Gold ticked lower in Asia prior to a brief bounce in Europe prior to further losses which have seen gold fall to 1,590.40 USD/oz. Gold is marginally lower in pounds at 1,015.80 GBP/oz and marginally higher in euros and Swiss francs at 1,263.30 EUR/oz and 1,517.70 CHF/oz.

Gold climbed $50.09 to as high as $1607.09 in early afternoon New York trade Friday and ended with a gain of 2.68% for a gain of 1.65% for the week. Gold made similar gains in other fiat currencies.

Silver surged to as high as $27.918 in early New York trade before it pared its gains a bit, but it still ended with a gain of 3.93% to close 2.1% higher for the week.

NEWSWIRE

(Bloomberg) -- U.S. Mint American Gold Coin Sales Climb to Highest Since March

The U.S. Mint sold 54,500 ounces of American Eagle gold coins last month, the most since March. Silver coin sales dropped 9.8 percent.

Sales of the gold coins rose 2.8 percent from 53,000 ounces in May, bringing the total for the year to 338,000 ounces, the Mint’s website shows. That compares with 576,000 ounces in the same six months last year. American Eagle silver coin sales fell to 2.59 million ounces last month, bringing the total for the first six months to 17.13 million ounces. The total was 22.3 million ounces in the same six months last year.

Gold futures advanced 2.6 percent in June, the first increase in five months on speculation that Europe’s debt crisis would boost demand from investors. Silver fell 0.5 percent.

(Bloomberg) -- Gold Traders Trim Bets on Price Rise, CFTC Data Shows

Hedge-fund managers and other large speculators decreased their net-long position in New York gold futures in the week ended June 26, according to U.S. Commodity Futures Trading Commission data.

Speculative long positions, or bets prices will rise, outnumbered short positions by 122,619 contracts on the Comex division of the New York Mercantile Exchange, the Washington-based commission said in its Commitments of Traders report. Net-long positions fell by 13,785 contracts, or 10 percent, from a week earlier.

(Bloomberg) -- Silver Traders Trim Bets on Price Rise, CFTC Data Shows

Hedge-fund managers and other large speculators decreased their net-long position in New York silver futures in the week ended June 26, according to U.S. Commodity Futures Trading Commission data.

Speculative long positions, or bets prices will rise, outnumbered short positions by 6,222 contracts on the Comex division of the New York Mercantile Exchange, the Washington-based commission said in its Commitments of Traders report. Net-long positions fell by 3,880 contracts, or 38 percent, from a week earlier.

(Bloomberg) -- Shanghai Gold Exchange to Lower Deferred Fee Ratio for Silver

The Shanghai Gold Exchange will lower the deferred fee ratio for forward silver contracts to 0.015%, from 0.02%, starting from the settlement on July 5, according to a statement posted on the bourse’s website today.

(Bloomberg) -- UBS Says Physical Gold Demand in India Increased on June 29

Physical gold demand in India on June 29 was “well above average,” with consumption that day the third-biggest throughout the second quarter, UBS AG said today in an e-mailed report.

(Bloomberg) – South Africa ANC Report Proposes Platinum Sales Limit, Business Day Says

A report compiled for South Africa’s ruling African National Congress proposes export tariffs on platinum sales, except when prevented by trade agreements, Business Day said, citing a copy of the State Intervention in the Minerals Sector report.

It also recommends that a state-owned mining company be given preferential rights to future discoveries of platinum group metals, the Business Day said, citing a copy of the document.

(Thomson Reuters Global Gold Forum) -- Barcap Bullish On Gold

Barclays Capital write in their regular "Gold Delta" report the macro environment remains bullish for gold, as do investor flows. Even with last week's decline in ETP holdings, these remain up on the month, Barcap say. "Broad ETP resilience and an inconsistent physical market have not provided sturdy downside support for prices yet, but price action over the coming weeks will rest in the hands of which role gold plays - safe haven or risky asset - ahead of this week's non-farm payrolls and as events in Europe unfold. Actual Q2 12: $1611/oz; Price forecast: Q2 12: $1665/oz; 2012 annual average: $1716/oz"

(Thomson Reuters Global Gold Forum) -- Commerzbank Optimistic On Gold

Commerzbank note that Friday's huge leap in price was not accompanied by large ETF inflows (quite the contrary) and there was another paring back in net long positions in the week to June 26 to the lowest since September 2007, while the number of shorts has also risen.

"In the long term, we regard the current scepticism displayed by speculators to be constructive, for most fears should meanwhile be “priced in”. According to one of the few helpful stock market adages, a contrary attitude pays off and “the bull is born among bears and grows in scepticism”. Thus precious metals could be nearing the end of their slump," Commerzbank say.

(Thomson Reuters Global Gold Forum) -- FastMarkets Call For Further Consolidation

"Encouragingly resilience amongst ETF investors and steady demand at the retail level are set to provide further background support however gold's rebound Friday again saw the metal stall at trend line resistance at $1607. With further resistance above around $1623 gold may have to send more time within its recent $1550-1625 range with short-term outlook still sideways to lower."

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Commerz Bank And Barclays Capital Positive On Gold

Published 07/02/2012, 04:13 AM

Commerz Bank And Barclays Capital Positive On Gold

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.