In a stunning development, the Comex Registered Silver inventories experienced a large one day decline yesterday. Nearly 10% of total Comex Registered Silver inventories were removed from the exchange on the last day of the year and reported on Jan. 4.

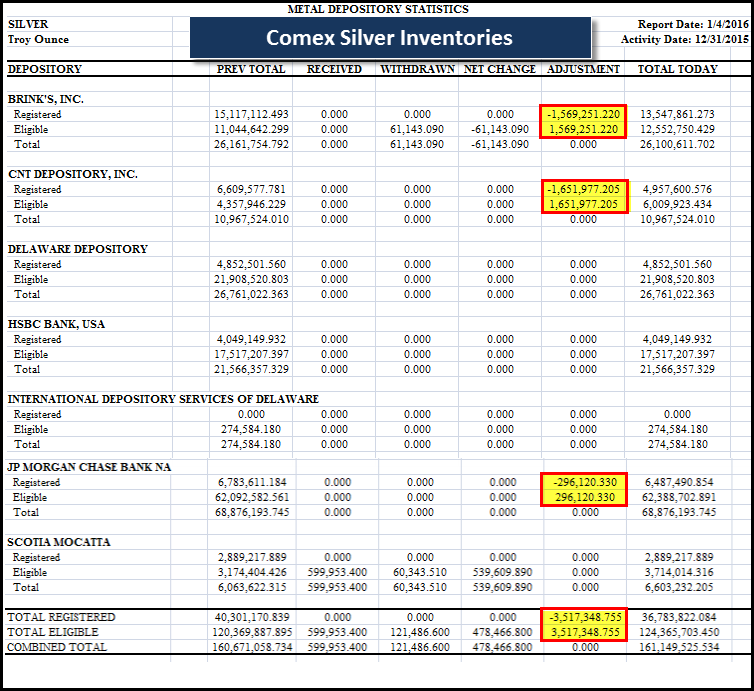

According to the CME Group’s Metal Depository Statistics, 3.5 million ounces (Moz) of Registered Silver Inventories were withdrawn and transferred to the Eligible category:

As we can see, there was 1.5 Moz transferred out of Brinks, 1.6 Moz from the CNT Depository and nearly 300,000 oz removed from JPMorgan (N:JPM) for a total of 3,517,348 oz. At the end of 2015 (Dec 31st), there were 40.3 Moz held in Registered Silver inventories at the Comex. After this large one day transfer, only 36.7 Moz remains.

This is an interesting development for two reasons:

- This is the lowest level the Comex Registered Silver inventories have been for the past three years and,

- The motivation for depositories to transfer that much silver out of its deliverable category.

First, the last time the Comex Registered Silver inventories were this low was in Feb 8th, 2013 at 36.2 Moz. The lowest the Registered Silver inventories fell to was 26.6 Moz in July 2011. However, the overall trend of the Registered Silver inventories was up until April, 2015… where they peaked at 70.5 Moz.

In just the past eight months, Registered Silver inventories at the Comex have fallen be nearly 50%. Again, Registered Silver inventories are those that are ready to be delivered into the market.

Second, something has motivated the holders of this silver to remove it so it is no longer able to be delivered into the market. If we assume that industrial silver demand has fallen due to a weaker U.S. and global economic activity and there is no longer a retail shortage of silver (as there was from June-Sept 2015), why are we continuing to see silver removed from the Registered Category?

You would think we would be seeing the opposite as the Registered Silver inventories started to build in August, 2011… after the peak and decline of the silver price and investment demand. And interestingly, the opposite is taking place at the Shanghai Future Exchange.

Shanghai Future Exchange Silver Inventories Surge End Of Year

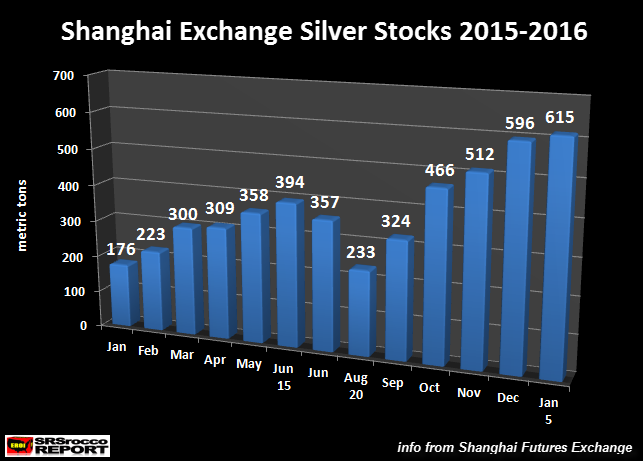

Silver inventories at the Shanghai Futures Exchange (SHFE) grew from a low of 176 metric tons (mt) in January 2015 to 394 mt in June. They bottomed in August at 233 mt and then continued to build steadily until spiking at the end of the year:

What is really interesting about the build of SHFE silver inventories is the rapid increase since Dec 28. On Dec 28, there were 535 mt of silver at the SHFE, only 23 mt higher than the beginning of the month. Then over the next week and including the first few days in 2016, total inventories at the Shanghai Futures Exchange jumped 80 mt to 615.

Precious metal investors need to realize the Chinese view gold more as an investment than silver. Furthermore, the Chinese also have to pay a 17% vat tax on silver investment. According to the 2015 World Silver Survey, Chinese silver bar investment demand was only 6.2 Moz in 2014 while Official Coins sales were 5.9 Moz. The notion that the Chinese are buying a lot of physical silver investment is not true… however, they are buying one hell of a lot of gold.

So, this spike of SHFE silver inventories must be motivated more by the decline of industrial silver demand in China than investment demand. China is the largest silver fabricator in the world as they consumed 5,788 mt (186 million oz) of silver in 2014 via industrial applications (2015 World Silver Survey).

Again, something very strange is happening here. The Comex continues to see a drain of its Registered Silver inventories (for delivery), while the SHFE inventories are showing a rapid increase.

It will be interesting to see what happens to the silver inventories at these two exchanges over the next 6 months. If Comex Registered Silver inventories continue to fall (just like the Gold Registered inventories), this could spell more trouble for the highly leveraged paper based precious metal markets going forward.