- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

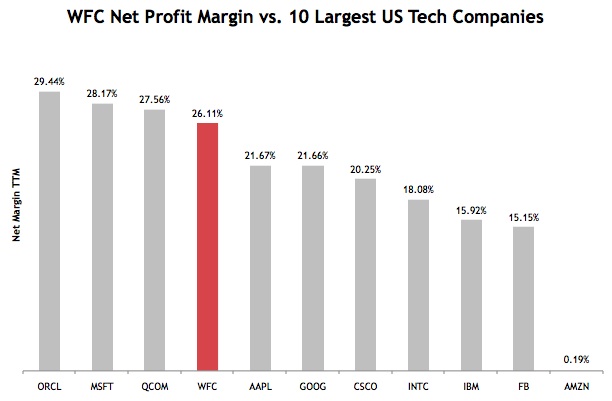

Clearly, Banking Is A Very Profitable Business

Bank of America Corporation, (BAC), JP Morgan Chase (JPM) and Wells Fargo & Company, (WFC) all reported earnings this week and the reports were generally pretty good. The mega banks have come a long way towards restoring profitability over the past five years. Wells Fargo in particular, which is arguably the healthiest bank of its peer group, was able to demonstrate the profit potential of these huge institutions.

In 2013, WFC earned a net profit of $21.9 B on $83 B in revenue, a 26% profit margin. To put that in context, below is Wells Fargo’s margin compared to the 10 largest US tech companies (by market cap). Technology is generally known to be a high margin industry, but Wells Fargo ranks right up there with those companies in terms of net profit margin. In fact, Wells Fargo’s profit margin is higher than Apple’s (APPL), Google’s (GOOG), and IBM’s (IBM), not to mention some other high margin, non tech companies like Coca-Cola (KO), Procter & Gamble (PG) and the Walt Disney Company, (DIS). Once BAC, JPM and Citigroup Inc, (C) have put their legacy issues to rest, there’s no reason to believe that they can’t reach similar levels of profitability.

Perhaps what’s more surprising is that even despite this profitability, Wells Fargo and its peers still trade at a huge discount relative to most non-bank blue chips. Compared to its book value, Wells Fargo is actually the most expensive of the mega banks, but even then it still only trades for about 11x earnings.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.