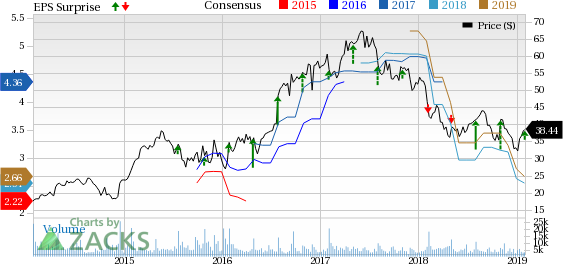

Cirrus Logic Inc. (NASDAQ:CRUS) delivered third-quarter fiscal 2019 non-GAAP earnings per share of 91 cents, which topped the Zacks Consensus Estimate of 78 cents but were much lower than the year-ago quarterly figure of $1.59.

Total revenues of $324.3 million surpassed the Zacks Consensus Estimate of $318 million. However, the top line was down 32.8% year over year and 11% sequentially due to reduction in sales of portable audio products shipping in smartphone. Further, weak unit volumes of one of its digital headset products caused the year-over-year decline.

Quarterly Details

Segment wise, portable audio product revenues (89% of total revenues) came in at $324 million, down 34.2% year over year. Non-portable audio and other products (11%) decreased 19% to $35.7 million.

Cirrus Logic’s largest customer, apparently Apple (NASDAQ:AAPL) , contributed to 83% of sales for the reported quarter. Notably, the company witnessed a solid traction in design wins and remained actively engaged with a number of new and existing customers.

Non-GAAP gross profit was $163.4 million, which plunged 30.6% on a year-over-year basis. Gross margin, however, grew 160 basis points (bps) to 50.4%.

Cirrus Logic’s non-GAAP operating expenses fell 7% to $100.3 million owing to cut in discretionary spending and deferring expenses.

Non-GAAP operating income of $63.1 million slumped 50.6%. Moreover, non-GAAP operating margin contracted 700 bps from the year-ago quarter to 19%.

Balance Sheet and Cash Flow

The company exited the quarter with cash and cash equivalents of $219.3 million compared with $195.9 million at the end of the earlier reported quarter.

Accounts receivables were $142.1 million compared with $206.8 million in the last reported quarter. Notably, the company did not have any long-term debt during the quarter under review.

The company repurchased 1.4 million shares worth $55 million during the quarter under discussion. As of Dec 29, 2018, it has $50 million remaining under the January 2018 share repurchase authorization. Further, the board adds up to $200 million left from the share buyback authorization.

Outlook

Owing to persistent weakness in smartphone unit sales, Cirrus Logic issued a tepid guidance for the fiscal fourth quarter. However, product introductions ahead of customer launches in the spring are expected to be a breather.

The company expects revenues between $200 million and $240 million. The Zacks Consensus Estimate for the metric is pegged at $251.4 million.

Management notes that expedited product development and elevated employee expenses, which include costs associated with payroll tax and benefits that occur in the March quarter, will be an overhang on margins.

Moreover, given the volatile macroeconomic environment and its uncertain impact on smartphone volumes, the company refrained from providing an outlook for fiscal 2020.

Nonetheless, the company anticipates revenues generated by Android customers to increase year over year in the next fiscal year, backed by content gains with various OEMs. Moreover, launch of products by both new and existing customers in fiscal 2020 also makes the management optimistic.

Zacks Rank and Stocks to Consider

Currently, Cirrus Logic has a Zacks Rank #4 (Sell).

A few better-ranked stocks in the broader Computer and Technology sector are Synopsys, Inc. (NASDAQ:SNPS) and Verint Systems Inc. (NASDAQ:VRNT) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for both Synopsys and Verint is projected to be 10%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Apple Inc. (AAPL): Get Free Report

Verint Systems Inc. (VRNT): Get Free Report

Synopsys, Inc. (SNPS): Free Stock Analysis Report

Cirrus Logic, Inc. (CRUS): Get Free Report

Original post

Zacks Investment Research