- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Chemical Stock Earnings Slated On Jan 26: APD, POL & VNTR

A few chemical companies have lined up to report their quarterly numbers on Jan 26. Per the Zacks Industry classification, the chemical industry is grouped under the broader Basic Materials sector, which is among the Zacks sectors expected to rack up the strongest gains in the fourth quarter. Overall fourth-quarter earnings for the sector are projected to climb 28.6% while revenues are expected to go up 18.3%, per the latest Earnings Outlook.

The chemical industry is riding high on an upswing in the world economy and continued strength across the major end-use markets such as construction, automotive and electronics. Another positive for the industry is a recovery in demand in the energy space — a key chemical end-market that had been out of favor for a while. The recovery has come on the back of by a rebound in crude oil prices from their historic lows.

Despite a few challenges including some lingering impacts of devastating hurricanes, chemical companies are expected to continue the earnings momentum witnessed in the third quarter into the December quarter as the fundamental driving factors remain firmly in place.

Strategic measures like productivity improvement, pricing actions, portfolio restructuring and earnings-accretive acquisitions are expected to continue to drive the performance of chemical makers in the fourth quarter.

We take a sneak peek at three chemical companies that are slated to report their quarterly results this Friday.

Air Products & Chemicals, Inc. (NYSE:APD) will report fiscal first-quarter earnings numbers ahead of the bell. The company has an Earnings ESP of -1.03% as the Most Accurate estimate stands at $1.64 while the Zacks Consensus Estimate is pegged at $1.66. While the stock carries a Zacks Rank #2 (Buy), its negative ESP makes surprise prediction difficult. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Air Products surpassed the Zacks Consensus Estimate in three of the trailing four quarters while missed in one, delivering an average beat of around 2.6%.

The Zacks Consensus Estimate for Air Products’ fiscal-first-quarter revenues stands at $2,159 million, reflecting an increase of 14.7% from the year-ago quarter.

Revenues for Air Products’ Industrial Gases — America segment is projected to witness a 5.6% year-over-year rise as the Zacks Consensus Estimate is pegged at $912 million. Moreover, Air Products’ Industrial Gases — Asia segment’s revenues are expected to increase 19.2% year over year as the Zacks Consensus Estimate stands at $522 million.

The Zacks Consensus Estimate for revenues for the Industrial Gases — EMEA segment is pegged at $466 million, reflecting a 16.5% rise year over year. The same for the Industrial Gases — Global segment stands at $135 million, representing year-over-year decline of 8.8%.

Air Products’ strategic investments in high-return projects, new business wins and acquisitions are expected to aid results. It also remains on track with its $600 million cost-reduction programs, which should support margins. (Read more: What's in the Cards for Air Products in Q1 Earnings?)

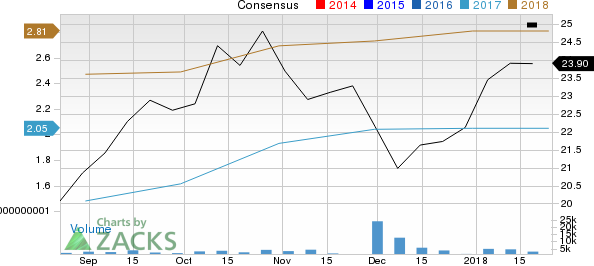

PolyOne Corporation (NYSE:POL) will report fourth-quarter results before the bell. The company is expected to come up with a positive earnings surprise as it has an Earnings ESP of +2.86% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

PolyOne topped the Zacks Consensus Estimate in three of the trailing four quarters, with an average beat of 5.6%.

The Zacks Consensus Estimate for revenues for the to-be-reported quarter stands at $741.8 million, reflecting a decline of 5.8% from the year-ago quarter.

The Zacks Consensus Estimate for sales of the company’s Color, Additives and Inks unit is pegged at $205 million, reflecting an increase of 10.8% on a year-over-year basis. The same for the Specialty Engineered Materials division stands at $144 million, representing year-over-year growth of 6.7%.

Moreover, the Zacks Consensus Estimate for Performance Products and Solutions division sales stands at $164 million, reflecting a rise of 3.8% from the year-ago quarter.

While PolyOne is exposed to headwinds from raw material cost inflation and unfavorable impacts of hurricanes, it is gaining from acquisitions and strategic investments in commercial resources. The company should benefit from the acquisition of specialty inks maker, Rutland Holding Company that has expanded its portfolio of specialty color, additives and inks solutions. Moreover, the buyout of Mesa has further broadened the company’s portfolio of color and additives solutions.

Venator Materials PLC (NYSE:VNTR) , which is expected to report fourth-quarter results on Jan 26, is expected to come up with a positive earnings surprise as it has an Earnings ESP of +56.46% and a favorable Zacks Rank #3 (Hold). The company posted a positive earnings surprise of 55.6% in the last reported quarter.

The Zacks Consensus Estimate for revenues for the to-be-reported quarter stands at $522 million, reflecting a decline of 10.3% from the sequentially prior quarter.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Air Products and Chemicals, Inc. (APD): Free Stock Analysis Report

PolyOne Corporation (POL): Free Stock Analysis Report

Venator Materials PLC (VNTR): Free Stock Analysis Report

Original post

Related Articles

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.