Shares of The Cheesecake Factory Inc. (NASDAQ:CAKE) declined nearly 8% in afterhours trading on May 3, after the company reported lower-than-expected first-quarter 2017 results. Further, a lowered fiscal 2017 outlook due to prevailing challenging restaurant environment led to the slump in the stock price.

Earnings and Revenue Discussion

Adjusted earnings of 72 cents per share fell short of the Zacks Consensus Estimate of 73 cents by 1.4%. Meanwhile, the figure increased 5.9% from the prior-year quarter earnings of 68 cents on higher revenues and a lower share count.

Sales of $563.4 million lagged the Zacks Consensus Estimate of $565.4 million by 0.4%, but rose 1.8% on a year-over-year basis.

Inside the Headlines

Comps at Cheesecake Factory restaurants increased a mere 0.3%, lower than comps growth of 1.7% a year ago and 1.1% in the preceding quarter. Menu price increase of 2.4% and positive mix of 0.2% drove comps, fairly offset by a 2.3% decline in traffic.

Cost of sales ratio decreased 70 basis points (bps) year over year to 22.9%. This was primarily attributable to lower groceries, dairy and meat costs. Meanwhile, labor expense ratio was 34.4%, 90 bps higher year over year owing to elevated wage rates as well as some deleverage.

General and administrative expenses accounted for 6.4% of revenues in the first quarter, in line with the prior-year quarter level. Notably, pre-opening expenses were roughly $1 million, down from $2.3 million in the year-ago quarter.

Second-Quarter 2017 Outlook

For the second quarter, adjusted earnings per share are guided in the range of 85 cents to 88 cents. Meanwhile, comps are anticipated to be in the band of 1% to 2% at Cheesecake Factory restaurants. Notably, this comps sales guidance assumes a roughly 50 bps positive impact because of the shift of Easter and the allied spring break vacations into the second quarter from the first quarter of 2016.

Fiscal 2017 Guidance Cut

The company slashed its fiscal 2017 adjusted earnings per share projection mainly to reflect the impact of modest tempering of its top line expectations for the remaining of 2017, as the expected improvement in the consumer environment has not so far played itself out.

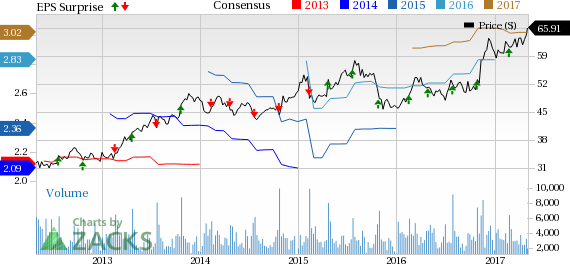

It now expects earnings in the range of $2.93 to $3.02 compared with $2.95 to $3.07, guided previously. Notably, the Zacks Consensus Estimate for fiscal 2017 earnings is pegged at $3.02.

Moreover, the company now expects comps growth in the range of 0.5% to 1.5%, down from 1–2% band, anticipated earlier.

Meanwhile, capital expenditures for the year are still projected in the range of $125–$140 million, including eight planned domestic openings and a few potential openings for early 2018.

Currently, Cheesecake Factory carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

McDonald's Corp. (NYSE:MCD) reported first-quarter adjusted earnings per share of $1.47, beating the Zacks Consensus Estimate of $1.32 by 11.4%. Earnings also increased 18% year over year.

Chipotle Mexican Grill, Inc.’s (NYSE:CMG) first-quarter 2017 adjusted earnings of $1.60 per share outpaced the Zacks Consensus Estimate of $1.28 by 25%. Also, earnings compared favourably with the year-ago quarter figure of a loss of 88 cents per share, given a substantial rise in revenues.

In first-quarter 2017, Yum! Brands, Inc. (NYSE:YUM) posted earnings of 65 cents per share that outpaced the Zacks Consensus Estimate of 60 cents by 8.3%. Further, earnings increased 17% year over year due to lower share count.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Yum! Brands, Inc. (YUM): Free Stock Analysis Report

Chipotle Mexican Grill, Inc. (CMG): Free Stock Analysis Report

The Cheesecake Factory Incorporated (CAKE): Free Stock Analysis Report

McDonald's Corporation (MCD): Free Stock Analysis Report

Original post

Zacks Investment Research