- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

GBP/USD: Pound Remains Subdued Ahead Of U.S. And British GDP Reports

GBP/USD has shown little movement since Tuesday, as the pair trades at 1.2340. On the release front, the highlight of the day is Final GDP. We’ll also get a look at Core Durable Goods Orders and unemployment claims. There are no UK releases on Thursday. On Friday, the US publishes New Home Sales and UoM Consumer Sentiment.

The US economy continues to expand in impressive fashion, as underscored by strong GDP forecasts for the third quarter. Preliminary GDP came in at 3.2%, beating the forecast of 3.0%. Final GDP is expected to be even stronger, with an estimate of 3.3%. If the indicator matches or beats this rosy prediction, the US dollar could respond with gains. In the UK, Second Estimate GDP posted a gain of 0.5%, matching the forecast. No change is expected in Final GDP.

The pound has not looked sharp in the fourth quarter, as GBP/USD has slipped as much as 4.9% during since October 1. The pound took another hit after the Federal Reserve raised rates last week. At the same time, British economic numbers have been respectable in Q4, as the economy has defied the doomsayers who forecast disaster after the Brexit referendum vote in June.

On Tuesday, CBI Realized Sales, which measures retail sales volumes, impressed with reading of 35 points. This marked the fastest pace of retail sales growth since September 2015. However, Britain and the European Union will soon begin tough negotiations over Britain’s departure, and if this leads to renewed Brexit jitters, the pound could respond with losses.

December seems to be that special time of year for the Federal Reserve. When the Federal Reserve raised interest rates in December 2015, the Fed confidently predicted a series of rate hikes in 2016 in order to keep a hot US economy in check. However, the Fed remained on the sidelines throughout 2016 and refrained from any rate hikes until last week. There were several false starts along the way, as expectations that the Fed would raise rates earlier in 2016 failed to materialize.

This led to sharp criticism of Janet Yellen for failing to provide a clear monetary policy. Yellen seems to have been keenly aware of this, as the Fed did everything short of buying advertisements in daily newspapers to get out the message that it planned to raise rates in December. Indeed, a rate hike was priced in as high as 100% by some analysts. Yellen deserves full marks for sending a clear message to the markets.

With the Fed finally pressing the rate trigger last week, what can we expect from Janet Yellen & Co.? In September, Fed officials predicted two rate hikes in 2017, but the Fed is now projecting three or even four hikes next year. However, projections need to be adjusted to economic conditions, and the markets will understandably be somewhat skeptical about Fed rate forecasts.

The upcoming Trump presidency is likely to shake things up in Washington, but Trump’s economic stance remains unclear. Still, there is growing talk about ‘Trumpflation’, with the markets predicting that Trump’s policies will increase inflation levels, which have been persistently weak. If inflation levels do heat up, there will be pressure on the Fed to step in and raise interest rates.

GBP/USD Fundamentals

Thursday (December 22)

- 8:30 US Final GDP. Estimate 3.3%

- 8:30 US Unemployment Claims. Estimate 255K

- 8:30 US Durable Goods Orders. Estimate -4.9%

- 8:30 US Final GDP Price Index. Estimate 1.4%

- 10:00 US HPI. Estimate 0.4%

- 9:00 US Core PCE Price Index. Estimate 0.1%

- 10:00 US Personal Spending. Estimate 0.4%

- 10:00 US CB Leading Index. Estimate 0.2%

- 10:00 US Personal Income. Estimate 0.3%

- 10:30 US Natural Gas Storage. Estimate -201B

Friday (December 23)

- 4:30 British Current Account. Estimate -28.3B

- 4:30 British Final GDP. Estimate 0.5%

- 10:00 US New Home Sales. Estimate 575K

- 10:00 US Revised UoM Consumer Sentiment. Estimate 98.2

*All release times are EST

* Key events are in bold

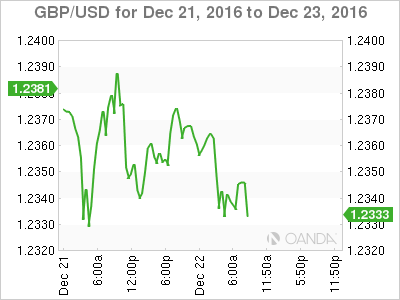

GBP/USD for Thursday, December 22, 2016

GBP/USD December 22 at 8:00 EST

Open: 1.2351 High: 1.2377 Low: 1.2322 Close: 1.2347

GBP/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1943 | 1.2111 | 1.2272 | 1.2351 | 1.2471 | 1.2620 |

- GBP/USD has showed limited movement in the Asian and European sessions

- 1.2272 is providing support

- 1.2351 was tested in resistance in remains a weak line

Further levels in both directions:

- Below: 1.2272, 1.2111 and 1.1943

- Above: 1.2351, 1.2471, 1.2620 and 1.2778

- Current range: 1.2272 to 1.2351

OANDA’s Open Positions Ratio

GBP/USD ratio is almost unchanged in the Thursday session. Currently, long positions have a majority (59%), indicative of trader bias towards GBP/USD breaking out and moving upwards.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Swiss franc is down for a second straight trading day. In the European session, USD/CHF is trading at 0.8980, up 0.38% on the day. Switzerland’s GDP Eases to 0.2% The Swiss...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.