- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Central Asia Metals: Potential £1.66 Per Share

Meeting targets, paying dividends, lowest costs

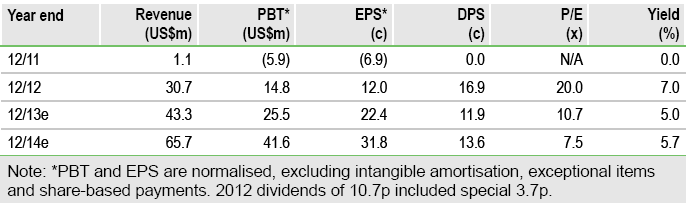

Central Asia Metals Plc's, (CAML) H113 production was in line with its full-year production target of 10kt copper cathode. Attributable (60%) gross revenue was US$21.2m from the sale of 5,035t at an average realised copper price of US$6,996/t. All-in costs of production remain in the lowest quartile for the industry at US$1.06/Ib, providing significant leeway during periods of copper price weakness. Continuing with its policy of returning value to shareholders, CAML will pay a 4p/share interim dividend (equal to 25% of attributable revenues) on 15 November 2013. An impairment of US$13.6m has been recorded for its non-core Mongolian assets, reducing their carrying value to zero, resulting in an H113 net loss of US$5.1m. We refrain from drawing comparison with 2012 production results as H113 is the first full six-month period when Kounrad has operated at steady state levels.

Western dumps yielding similar Cu recoveries to east

CAML has already notified the market that its pilot-scale testing of the much larger sulphidic western dumps has indicated potential copper recoveries of 40-45%, ie similar to recovery rates at the eastern dumps. This is due to higher degrees of natural oxidation (by bacterial action) of the sulphide and mixed dumps since their creation in the Soviet era 70-80 years ago.

Costs: Comfortably within lowest quartile

CAML’s H113 direct cash cost of production (C1 equivalent) is US$0.76/Ib. Even factoring in its other overheads (Kazakh MET tax, Balkhash G&A, depreciation, distribution and selling costs), it still ranks only sixth cheapest at US$1.06/Ib. We also consider that all its peers carry by-product credits, where CAML has none.

Valuation: Potential £1.66 per share (fully diluted)

Following the interims we adjust our model for a slight 7% increase in G&A costs from US$6.25m to US$6.70m for FY13, an 8.2% increase in all-in operating costs from US$2,167/t to US$2,344/t (largely due to cost and increased consumption of electricity due to a particularly harsh Kazakh winter). The average copper price received was 11.8% lower at US$6,996/t (vs FY12 of US$7,935/t). This results in our per share valuation remaining at £1.66, based on only the oxide material being re-treated to 2029 (the last year of operation under this scenario), a 10% discount rate and copper prices of US$3.21/Ib for 2013, and US$2.96/Ib long term. Our valuation assumes successful completion of the SAT deal in Q114, with CAML accounting for 100% of Kounrad’s profits from 1 January 2014.

To Read the Entire Report Please Click on the pdf File Below.

Related Articles

The silver market is forecast to record a fifth straight market deficit in 2025, with demand once again outstripping supply, and the majority of the existing above ground silver...

Trumping Brent Oil Futures. Oil got Trumped and dumped. While many people feared that President Trump aggressive trade negotiations would raise the price of oil, so far oil has...

Upon analysis of the wobbly moves since Tuesday, when the natural gas futures tested the two-year high at $4.55, Thursday might be a cozy one, as the inventory announcements after...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.