- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Celgene (CELG) Down 8.4% Since Earnings Report: Can It Rebound?

A month has gone by since the last earnings report for Celgene Corporation (NASDAQ:CELG) . Shares have lost about 8.4% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to its next earnings release, or is CELG due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

Celgene Q4 Earnings & Sales Beat on Solid Revlimid

Celgene reported encouraging fourth-quarter 2017 results wherein both earnings and sales topped expectations.

The company reported adjusted earnings of $2.00 per share which beat the Zacks Consensus Estimate of $1.95, up from $1.61 in the year-ago quarter.

Total revenues grew 16.7% to $3.48 billion in the quarter and beat the Zacks Consensus Estimate of $3.47 billion. Revenues were boosted by consistent performance of the company’s key growth driver, Revlimid.

Revlimid – A Key Catalyst

Net product sales increased 17% year over year to $3.48 billion. Net sales of Revlimid came in at $2.2 billion, reflecting 21% year-over-year growth. The drug performed well in the United States (up 24%). Growth in the quarter was driven by increased volume as a result of increases in duration of treatment and market share.

Net sales of another cancer drug, Abraxane decreased 6% to $251 million as sales declined the United States. Sales of oncology drug, Pomalyst/Imnovid, came in at $442 million, up 17%. Sales were driven by increased volume due to increases in market share and duration.

Otezla reported sales of $371 million in the quarter, up 22%. All other product sales (including Istodax, Thalomid, Vidaza and an authorized generic version of Vidaza in the United States) totaled $227 million in the quarter, up from $220 million from the year-ago quarter.

Adjusted research and development expenses increased 13.8% to $766 million due to increased spending related to drug discovery and clinical trial activity while adjusted selling, general and administrative expenses decreased 28.9% to $687 million.

Earlier in the week, Celgene announced that it will acquire Juno Therapeutics, Inc. for $87 per share in cash, or a total of approximately $9 billion, net of cash and marketable securities acquired. The former already owns approximately 9.7% of outstanding shares of Juno. Celgene also announced that it will acquire Impact Biomedicines for an upfront amount of $1.1 billion. The acquisition will add a late stage candidate, fedratinib, a highly selective JAK2 kinase inhibitor, to Celgene’s pipeline.

In December 2017, Celgene and partner bluebird bio presented updated data from the phase I trial evaluating bb2121 in patients with relapsed and/or refractory multiple myeloma (RRMM). The candidate was granted Breakthrough Therapy Designation by the FDA and PRIority MEdicines eligibility by the European Medicines Agency. The companies also initiated the KarMMa trial evaluating bb2121 in RRMM was initiated.

2017 Results

Sales came in $13.0 billion, up from $11.3 billion in 2016 and beat the Zacks Consensus Estimate of $12.98 billion. Earnings per share came in at $7.44 in 2017, up from $5.94 in 2016 and beat the Zacks Consensus Estimate of $7.37.

2018 Outlook

Celgene anticipates earnings in the range of $8.70-$8.90. The Zacks Consensus Estimate for earnings is $8.78 per share. Net revenues are projected to be in the range of $14.4-$14.8 billion, while the Zacks Consensus Estimate for the same is pegged at $14.90 billion.

Revlimid sales are projected around $9.4 billion. Abraxane sales are estimated to be around $1 billion. Pomalyst’s revenues are projected around $1.9 billion. Otezla sales are now projected at $1.5 billion.

How Have Estimates Been Moving Since Then?

Analysts were quiet during the last month as none of them issued any earnings estimate revisions.

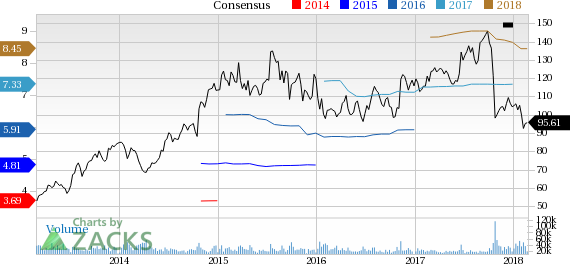

Celgene Corporation Price and Consensus

VGM Scores

Currently, CELG has a strong Growth Score of A, though it is lagging a lot on the momentum front with a C. The stock was allocated a grade of B on the value side, putting it in the top 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of A. If you aren't focused on one strategy, this score is the one you should be interested in.

Based on our scores, the stock is primarily suitable for growth investors while also being suitable for those looking for value and to a lesser degree momentum.

Outlook

CELG has a Zacks Rank #4 (Sell). We expect a below average return from the stock in the next few months.

Celgene Corporation (CELG): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.