Celanese Corporation (NYSE:) will increase the list and off-list selling prices of acetyl intermediate products. The price hike will be effective immediately or as contracts permit.

The company will increase the price of Acetic Acid and Acetic Anhydride by ¥300/MT in China and $50/MT in Asia outside China. In Europe and Middle East, prices of Acetic Acid and Acetic Anhydride will rise by €75/MT and €350/MT, respectively. Price of Acetic Acid and Acetic Anhydride will be hiked by 4 cents per lb and 10 cents per lb in United States and Canada. In Mexico & South America, prices of the same will increase by $100/MT and $250/MT, respectively.

Celanese is taking appropriate pricing actions amid a volatile raw material pricing environment. Pricing improvement drove margins in its Acetyl Chain unit in third-quarter 2017.

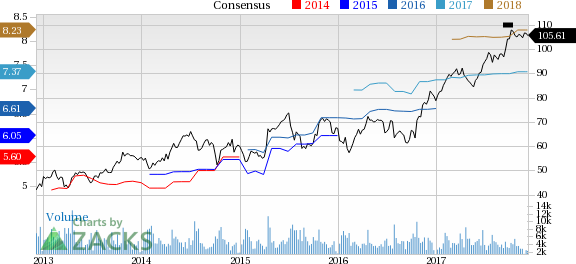

Celanese has outperformed the

industry over the last six months. The company’s shares have moved up around 19.8% over this period compared with roughly 14.9% gain recorded by the industry.

The company expects business and productivity momentum to offset fourth-quarter weakness. Celanese is optimistic that it can grow its adjusted earnings per share for 2017 toward the top end of its earlier announced guidance range of 9-11%.

Celanese’s strategic measures including operational cost savings through productivity actions and pricing initiatives are likely to lend support to its earnings in 2017. The company is also poised to gain from growth initiatives that include acquisitions. Moreover, Celanese remains focused on returning value to shareholders.

Celanese Corporation Price and Consensus

Celanese Corporation Price and Consensus | Celanese Corporation Quote

Zacks Rank & Other Stocks to Consider

Celanese currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the basic materials space are Kronos Worldwide Inc. (NYSE:) , Koppers Holding Inc. (NYSE:) and Westlake Chemical Corporation (NYSE:) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Kronos Worldwide has expected long-term earnings growth of 5%. Its shares have gained 103.5% year to date.

Koppers has expected long-term earnings growth of 18%. Its shares have rallied 21.6% year to date.

Westlake Chemical has expected long-term earnings growth of 10.6%. Its shares have moved up 74.5% year to date.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them.

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.