- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

CAR-T Therapy Space 2017 Progress Report

The immuno-oncology space has been in the limelight in 2017. The CAR-T therapy space in particular, has been grabbing investors, courtesy of two key approvals.

The FDA’s approval of Novartis AG’s (NYSE:NVS) breakthrough gene transfer treatment, Kymriah (tisagenlecleucel) suspension for the treatment of B-cell precursor acute lymphoblastic leukemia (ALL) that is refractory or in second or later relapse in patients up to 25 years of age was a significant boost for this space. Kymriah, formerly CTL019, is the first chimeric antigen receptor T-cell (CAR-T) therapy approved.

A novel immunocellular therapy and one-time treatment, Kymriah uses patient's T cells to fight cancer. Novartis also submitted a supplemental Biologics License Application to the FDA for Kymriah (tisagenlecleucel) suspension for intravenous infusion for the treatment of adult patients with relapsed or refractory (r/r) diffuse large B-cell lymphoma (DLBCL) who are ineligible for autologous stem cell transplant (ASCT). Kymriah was given Breakthrough Therapy designation for r/r DLBCL which, if approved, will be the second indication for Kymriah.

While the long-term impact of the treatment is yet to be evaluated, the approval opens up new frontiers for cancer treatment. To start with, CAR-T uses patient’s cells to identify and destroy cancer cells, thereby making it different from other small molecule or biologic therapies. During the treatment, T cells are drawn from a patient's blood. These cells are then reprogramed in the manufacturing facility to create genetically coded cells. This leads to the creation of a chimeric antigen receptor which recognizes and fights cancer cells and other B cells expressing a specific antigen.

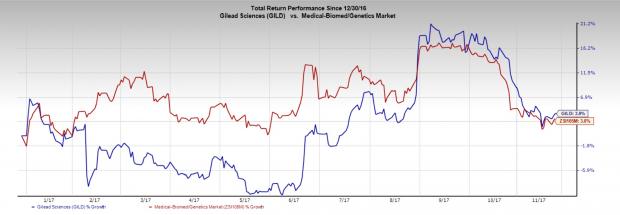

Gilead Sciences, Inc. (NASDAQ:GILD) acquired Kite Pharma to foray into this space. The FDA’s approval of Yescarta (axicabtagene ciloleucel), the latter’s CAR-T therapy candidate provided a significant boost. The FDA approved the therapy as a treatment for refractory aggressive non-Hodgkin lymphoma, which includes DLBCL, transformed follicular lymphoma and primary mediastinal B-cell lymphoma. The therapy is also under review in Europe and an approval is expected in 2018. Gilead also acquired therapy candidates in clinical trials in both hematologic cancers and solid tumors, including KITE-585, a CAR-T therapy candidate that targets B-cell maturation antigen expressed in multiple myeloma.

Given the vast potential of the therapy, biotech companies are leaving no stone unturned to develop their pipeline candidates. Nevertheless, stiff competition continues to remain a major concern.

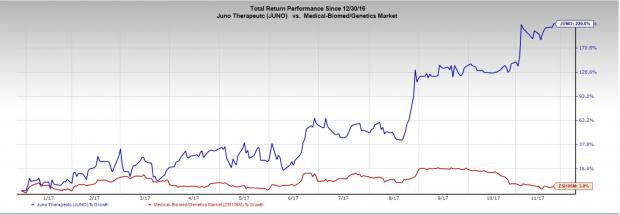

Juno Therapeutics, Inc. (NASDAQ:JUNO) is developing cell-based cancer immunotherapies based on CAR and high-affinity TCR technologies to genetically engineer T cells to recognize and kill cancer cells. The company is currently conducting a phase I trial with JCAR017 in adult r/r aggressive NHL, including r/r DLBCL. The company plans to initiate a phase I/II trial with JCAR017 in r/r chronic lymphocyctic leukemia (CLL) in the fourth quarter of 2017.

The company expects the FDA to approve r/rDLBCL in 2018 and r/r CLL in 2019. Shares of the company have surged a whopping 220% year to date. The company currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

bluebird bio, Inc. (NASDAQ:BLUE) in collaboration with Celgene Corp. (NASDAQ:CELG) is evaluating bb2121, a CAR-T cell product candidate for the treatment of multiple myeloma in a phase I study. bb2121 targets b-cell maturation antigen (BCMA) in previously treated patients with multiple myeloma. It was granted a Breakthrough Therapy status by the FDA. Both companies are also developing a second anti-BCMA CAR-T program, bb21217. Shares of the company have increased 171.0% year to date. The company presently carries a Zacks Rank #3.

ZIOPHARM Oncology, Inc. (NASDAQ:ZIOP) is developing CAR-T cell therapies for advanced lymphoid malignancies. The company is currently enroling patients for an investigator-led phase I study using second-generation CD19-specific CAR+ T cells with a revised CAR structure in patients with advanced lymphoid malignancies. The company at present carries a Zacks Rank #2 (Buy).

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Novartis AG (NVS): Free Stock Analysis Report

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

Celgene Corporation (CELG): Free Stock Analysis Report

ZIOPHARM Oncology Inc (ZIOP): Free Stock Analysis Report

bluebird bio, Inc. (BLUE): Free Stock Analysis Report

Juno Therapeutics, Inc. (JUNO): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Over the weekend I warned about the weakness in the Semiconductor sector (SMH). I also wrote about Granny Retail XRT, and how important it is for that sector to stay alive. Both...

Pretty rough day out there—S&P 500 down about 1.8%, Nasdaq down around 2.2%, and small caps hit even harder, dropping 2.7%. However, the S&P 500 is approaching a crucial...

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.