In its year-end update, BPI (BPI.L) appears to have finished FY12 at or slightly above our estimate. As H1 matched the previous year, this suggests modest y-o-y progress in H2. Polymer price trends are still gently downwards in the concluding months of the year, although management remains alert to a possible uptick early in the new year. BPI has outperformed the market by c 10% ytd, but still sits on a modest rating.

Meeting original estimates despite market challenges

Compared to the 5% volume decline in H1, the Q3 update noted that volumes had been much closer y-o-y and this has continued so far in Q4. Silage product, which has experienced good sales again in FY12, is a less significant contributor at the year end and so it seems reasonable to conclude that there has been no further overall deterioration in other areas at the year end. A gentle easing in polymer prices has probably helped the overall trading environment. Interestingly, our current FY12 volume projection is 7% lower compared to the beginning of the year, but higher revenue and profit per tonne – in higher average polymer price conditions – have compensated for this, leaving overall estimates unchanged.

Continuing to invest and generate cash

FY12 has seen an increase in capex (to c £18m versus c £14m depreciation) as a number of new projects, including a new silage stretchwrap line in Zele and a new recycling plant at Rhymney, have been brought on stream. More is to come (eg new co-extrusion equipment in Sevenoaks) and, together with more efficient running elsewhere (eg the extra-wide film line at Ardeer), this spend should increasingly benefit FY13 and beyond. At the same time, BPI has been nudging up its ROCE to around the mid-teens level in what remain generally unhelpful market conditions. We expect BPI to continue to deliver debt reduction year-on-year, although sustaining the £23m seen at the interim stage (versus £31m at the start of the year) would be a challenge in our view.

Valuation: Low rating despite business improvement

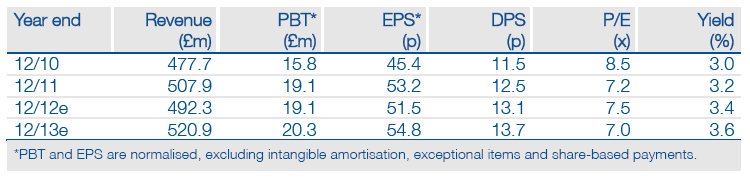

BPI’s share price has traded between 375-395p since the Q3 update on 6 November and currently sits in the middle of that range. The closing-year PER stands at just 7.5x with EV/EBITDA at 3.6x and, on our estimates, the four-times covered DPS gives a 3.4% yield. This gives little credit for the business investment and improvement undertaken in the last three years in difficult market conditions. Driving returns ahead and generating cash will continue to endorse these actions ahead of a more demonstrable increase in profitability to be driven, at some point, by rising volumes.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

British Polythene Industries: Ending The Year On A Positive Note

Published 12/23/2012, 10:56 PM

Updated 07/09/2023, 06:31 AM

British Polythene Industries: Ending The Year On A Positive Note

Ending the year on a positive note

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.