Shares of Bristol-Myers Squibb Company (NYSE:BMY) gained about 5% after the company ended its phase III combination study, CheckMate-214, earlier than expected after it met its co- primary endpoint.

The phase III study evaluated Opdivo plus Yervoy in patients with previously untreated advanced or metastatic renal cell carcinoma (RCC) and met its co-primary endpoint. The study showed superior overall survival (OS) compared to current standard of care sunitinib (marketed as Sutent by Pfizer (NYSE:PFE) ) in intermediate- and poor-risk patients.

In fact, the combination of Opdivo and Yervoy also met the secondary endpoint of improved overall survival in all randomized patients. Based on a planned interim analysis, an independent Data Monitoring Committee (DMC) recommended that the study be stopped early. But the safety and tolerability of the combination treatment observed in the study was consistent with previous reports of this dosing schedule and similar across subgroups.

In August 2017, Bristol-Myers announced top-line results from CheckMate-214 study, where the study met the co-primary endpoint of objective response rate (ORR). Markedly, the co-primary endpoint of progression-free survival favored the combination of Opdivo and Yervoy versus sunitinib but did not reach statistical significance.

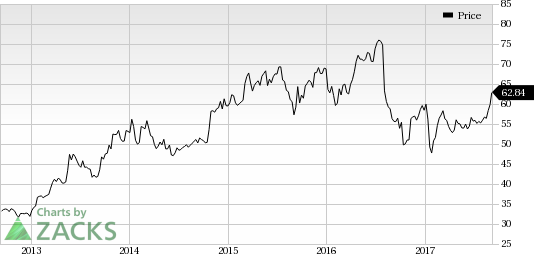

Bristol-Myers’ shares have underperformed the industry year to date. The stock has been down 7.5% compared with the industry’s gain of 10.2% in the same time frame.

We note that Opdivo became the first PD-1 inhibitor to be approved for a hematological malignancy — classic Hodgkin lymphoma — in the United States (May 2016) and the EU (November 2016).

In November 2016, Opdivo gained the FDA approval for the treatment of patients with recurrent or metastatic squamous cell carcinoma of the head and neck with disease progression on or after platinum-based therapy.

In fact, renal cell carcinoma is the most common type of kidney cancer in adults and has a huge unmet medical need. Thus, label expansion into additional indications would give the product access to a higher patient population and increase the commercial potential of the drug.

Additionally, the company entered into a collaboration agreement with Seattle Genetics, Inc. (NASDAQ:SGEN) in June 2017. Per the deal, Bristol-Myers will evaluate the combination of Opdivo and Seattle Genetics’ antibody drug conjugate (ADC) Adcetris in a phase III trial as a potential treatment option for patients with relapsed/refractory or transplant-ineligible advanced classical Hodgkin lymphoma (HL).

However, Bristol-Myers suffered a setback in January 2017 when it decided not to pursue the accelerated regulatory pathway for the regimen of Opdivo plus Yervoy in first-line lung cancer in the United States based on a review of available data.

Currently, Opdivo is facing competitive challenges in the United States. With the FDA approving Merck’s (NYSE:MRK) Keytruda, for the first-line treatment of metastatic nonsquamous NSCLC, the company is expected to suffer further loss of market share.

Zacks Rank

Bristol-Myers currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market. Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Bristol-Myers Squibb Company (BMY): Free Stock Analysis Report

Pfizer, Inc. (PFE): Free Stock Analysis Report

Merck & Company, Inc. (MRK): Free Stock Analysis Report

Seattle Genetics, Inc. (SGEN): Free Stock Analysis Report

Original post

Zacks Investment Research