- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Bright Near-Term Outlook For Alternative Energy Industry

The Zacks Alternative Energy industry can be fundamentally segregated into two sets of companies. While one group is involved in the generation and distribution of alternative energy and electricity from sources like wind, natural gas, biofuel, hydro and geothermal, the other set is engaged in development, design and installation of renewable projects involving these alternative energy sources.

The industry also includes a handful of stocks that offer fuel cell energy solutions, which have gained popularity as an affordable clean energy of late.

Per a report by Bloomberg Green, in 2019, clean energy investment in the United States totaled $55.5 billion, reflecting a 28% increase from prior year’s spending.

Here are the three major industry themes:

- Among alternative energy sources, wind energy continues to make noticeable progress in the United States. Per a report by the U.S. Energy Information Administration (EIA), annual electricity generation from wind energy in the nation exceeded hydroelectric generation for the first time in 2019. Government policies like extended federal Investment Tax Credit (ITC) for offshore wind energy along with extension of production tax credit have boosted wind capacity additions, lately. Also, a steadily decreasing input price along with increasing flow of investments from all over the world has been instilling growth in the wind industry. All these factors enabled annual wind generation in the United States to total 300 million megawatt-hours (MWh) in 2019, exceeding hydroelectric generation by 26 million MWh. With wind investments worth $62 billion in new projects aimed over the next few years, per an estimate provided by the American Wind Energy Association, the outlook for the alternative energy industry seems favorable.

- We remain bullish about the outlook for the U.S. alternative energy industry based on the fact that rapid installation of clean energy and their declining costs are boosting the energy storage market. Per a report by National Renewable Energy Laboratory (NREL), the price of lithium-ion batteries has decreased by approximately 80% over the past five years and the United States saw a 93% year-over-year increase in storage deployed in the third quarter of 2019. Going ahead, per a forecast by Wood Mackenzie Power & Renewables, annual storage deployments in the United States will be more than 5.4 gigawatts by 2024.Such growth prospects of the energy storage space should attract more investors to choose stocks from this industry.

- Trump dealt a blow to the U.S. alternative energy industry by imposing an import tariff of 25% on steel and 10% on aluminum in March 2018. In January 2020, another roundof tariffs was imposed on steel and aluminum derivatives like imported nails, staples, electrical wires and a few more. Steel and aluminum are widely used as raw materials to construct critical wind turbines, storage and hydroelectric components. After 2018’s tariff imposition, GTM Research, MAKE Consulting and Wood Mackenzie collectively calculated that such imposition can push uplevelized cost of energy for U.S. renewable power plants by 3 – 5%, thereby leading to slightly lowered forecast for project deployments or slightly lowered project returns. Now the extension of such tariffs may weigh heavily on the industry’s growth trajectory.

Zacks Industry Rank Reflects Bright Outlook

The Zacks Alternative Energy industry is housed within the broader Zacks Oils-Energy sector. It carries a Zacks Industry Rank #108, which places it in the top 43% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bright near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Before we present a few alternative energy stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Lags S&P 500, Beats Sector

The Alternative Energy Industry has underperformed the Zacks S&P 500 composite but outperformed its own sector over the past year. The stocks in this industry have collectively lost 28.6% while the Oils-Energy Sector and the Zacks S&P 500 composite have declined 51.5% and 5.3%, respectively in the same timeframe.

One-Year Price Performance

.jpg)

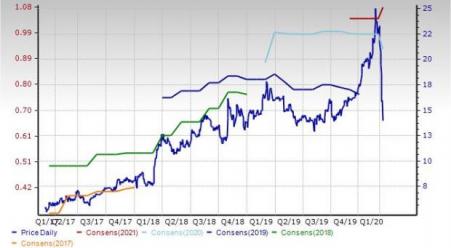

Industry’s Current Valuation

On the basis of trailing 12-month EV/EBITDA ratio, which is commonly used for valuing alternative energy stocks, the industry is currently trading at 3.07 compared with the S&P 500’s 10.05 and the sector’s 3.63.

Over the last five years, the industry has traded as high as 4.05X, as low as 2.88X, and at the median of 3.57X, as the charts show below.

EV-EBITDA Ratio (TTM)

Bottom Line

Per a report by the U.S. Energy Information Administration (EIA), in 2019, about 4.12 trillion kWh was generated at utility-scale electricity generation facilities in the United States, of which 18% was from renewable energy sources. Although fossil fuel continues to dominate the nation’s electric generation count, the contribution from renewables is set to increase significantly in the next few years. Therefore, investing in the alternative energy space should be profitable for investors.

However, the imposition of tariffs may hurt investors’ sentiment to some extent.

Nevertheless, given its favorable industry rank, investors may bet on a few alternative energy stocks that exhibit a strong earnings outlook. Also, there are some players in this space that shareholders might want to hold on to.

Here we present four alternative energy stocks with a Zacks Rank #2 (Buy) or 3 (Hold) that investors may want to invest in or retain for the time being. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Evergy Inc. (EVRG): For this Kansas City, MO-based company, the Zacks Consensus Estimate for current-year earnings indicates year-over-year improvement of 8%. It came up with a positive surprise of 1.80% in the last reported quarter. It carries a Zacks Rank #2.

Ameresco Inc. (AMRC): For this Framingham, MA-based company,the Zacks Consensus Estimate for current-year earnings indicates year-over-year improvement of 12.1%. It came up with average positive surprise of 17.95% in the last reported quarter. It carries a Zacks Rank #3.

Bloom Energy Corp (BE): For this San Jose, CA-based company, the Zacks Consensus Estimate for the current year indicates year-over-year bottom-line improvement of 44.4%. It came up with average positive surprise of 60.12% in the trailing four quarters. It carries a Zacks Rank #3.

FuelCell Energy, Inc. (FCEL): For this Danbury, CT-based company, the Zacks Consensus Estimate for fiscal 2020 bottom line indicates year-over-year improvement of 73.9%. It came up with average positive surprise of 2.35% in the trailing four quarters. It carries a Zacks Rank #3.

FuelCell Energy, Inc. (FCEL): Free Stock Analysis Report

Evergy Inc. (EVRG): Free Stock Analysis Report

Bloom Energy Corporation (BE): Free Stock Analysis Report

Ameresco, Inc. (AMRC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.