- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

BofA (BAC) Racing Past Other Banks Since 2016: Here's How

Bank of America Corporation (NYSE:BAC) (NYSE:C) is among the best post-financial crisis success stories. The company’s financial performance has witnessed a significant turnaround over the last couple of years. This, in turn, has aided the stock’s rally.

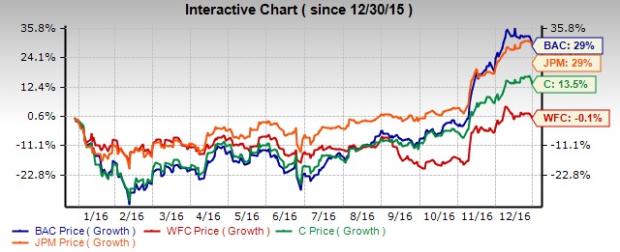

If we look at 2016, BofA’s performance was one of the best. This was driven by several favorable macroeconomic factors like rising interest rates, improving economy and a rise in client activity.

Success of BofA’s cost control initiatives, steady rise in loans and deposits, higher trading revenues and steadily improving asset quality supported its performance last year. Moreover, election of Donald Trump as President acted as a catalyst. However, slump in energy sector marginally hurt the company’s performance. But this was more than offset by positive factors.

In 2016, the company’s shares rallied 29.1%, thus being the best performer compared with JPMorgan (NYSE:JPM) , Citigroup (NYSE:C) and Wells Fargo (NYSE:WFC) .

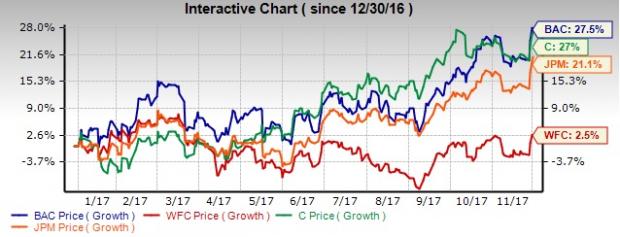

Similarly, this year, BofA’s fundamental strength has continued to aid its profitability amid a slightly challenging operating backdrop as trading and mortgage banking activities slowed down. Nonetheless, easing margin pressure, given the two rate hikes announced this year and stable oil prices drove its financials. Further, the company has been steadily lowering its long-term debt.

Additionally, BofA along with others cleared the annual stress test. Notably, the company’s 2017 capital plan of a whopping 60% dividend hike and $12 billion share repurchase authorization was among the biggest. This reflected its strong balance sheet position and cheered investors.

After initial hiccups, electoral promises by President Trump including easing of regulatory burden for banks and tax reforms seem to be moving forward. Further, encouraging economic data and stability in the Fed’s policy despite change in leadership continue to drive the stock up.

So far this year, the company’s shares have jumped 27.5%. This is the best among big banks, with Citigroup coming the close second at 27%.

Nonetheless, chances of Citigroup surpassing BofA’s price performance this year are less. Citigroup continues to face margin pressure owing to persistent decline in its legacy holdings portfolio despite rise in rates. This remains a big concern and investors seem to be wary.

Therefore, BofA is likely to retain its top spot. With high chance of another rate later this month, investors seem to be bullish on the stock. Also, with improvement in economy, demand for loans will continue to rise.

Further, BofA seems undervalued when compared with the broader industry as its current price/book and price/sales ratios are lower than the respective industry averages. Therefore, given the strong fundamentals, the stock has upside potential.

Currently, BofA carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

J P Morgan Chase & Co (JPM): Free Stock Analysis Report

Wells Fargo & Company (WFC): Free Stock Analysis Report

Citigroup Inc. (C): Free Stock Analysis Report

Bank of America Corporation (BAC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.