- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

BioScrip (BIOS) Loss Widens In Q4, '18 View Holds Promise

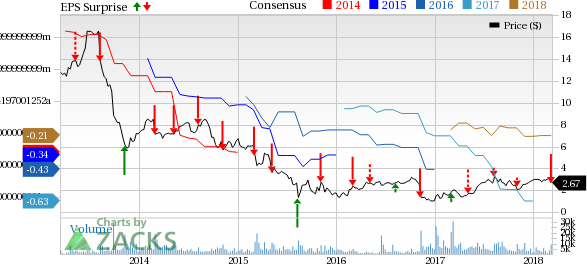

BioScrip, Inc. (NYSE:BIO) reported adjusted net loss from continuing operations of 15 cents per share in the fourth quarter of 2017, wider than both the Zacks Consensus Estimate and the year-ago loss of 8 cents each.

Reported net loss from continuing operations for the period came in at 58 cents a share, wider than the year-earlier loss of 46 cents.

Revenues

With the completion of non-core PBM business divestment, BioScrip now has a simplified business structure focused on core Infusion Services.

Net revenues for the quarter under review were $182.6 million, a 23.9% decline year over year. This huge downside resulted from the company’s shift in strategy to focus on growing its core revenue mix. This apart, the impact of the Cures Act and contract modifications with UnitedHealthcare (completed as of Sep 30, 2017) were major deterrents. However, the top line exceeded the Zacks Consensus Estimate of $172 million.

Notably, net revenues in the fourth quarter included core product mix of 75.7%, an improvement from 69.6% in the prior-year period.

Gross margin for the reported time frame expanded 740 basis points (bps) year over year to 38.5%.This significant upside was driven by seasonal revenue strength leveraging the company’s infrastructure and reduced product cost. Operating expenses were $53.5 million, an 18% reduction from the tally in fourth-quarter 2016.

Financials

BioScrip exited 2017 with cash and cash equivalents of $39.5 million compared with $9.6 million at the end of 2016.

2018 Guidance

For 2018, the company has provided revenue view in the range of $710-$720 million. The Zacks Consensus Estimate of $722.13 million for the metric lies above the company’s guided range.

Additionally, BioScrip expects to incur restructuring expenses in the band of $5-$6 million in 2018, primarily reflecting costs related to redesigning and optimizing its revenue cycle management process. The company also expects 2018 capital expenditures between $12 million and $14 million.

Our Take

BioScrip exited the fourth quarter on a dismal note with lower-than-expected earnings performances. Although, revenues were above the consensus mark, the huge year-over-year decline was a disappointment.

Nonetheless, we are encouraged by the company’s progress in the fourth quarter, courtesy of its new multi-faceted CORE plan to improve the financial position. The company also expects core revenues at Home Solutions and continued core growth to be accretive to its portfolio. Moreover, we are upbeat about BioScrip’s completion of the UnitedHealthcare contract transition and projections of core revenue rise. Besides, management’s outlook for 2018 sounds promising.

Zacks Rank & Key Picks

BioScrip has a Zacks Rank #3 (Hold). A few better-ranked stocks in the broader medical sector are PerkinElmer (NYSE:PKI) , Bio-Rad Laboratories (NYSE:BIO) and athenahealth, Inc. (NASDAQ:ATHN) .

PerkinElmer has a long-term expected earnings growth rate of 12.3%. The stock carries a Zacks Rank #2 (Buy).

Bio-Rad Laboratories sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.The company has a long-term expected earnings growth rate of 20%.

athenahealth is a Zacks #1 Ranked player. The company has a long-term expected earnings growth rate of 21.5%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

athenahealth, Inc. (ATHN): Free Stock Analysis Report

PerkinElmer, Inc. (PKI): Free Stock Analysis Report

Bio-Rad Laboratories, Inc. (BIO): Free Stock Analysis Report

BioScrip, Inc. (BIOS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.