- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

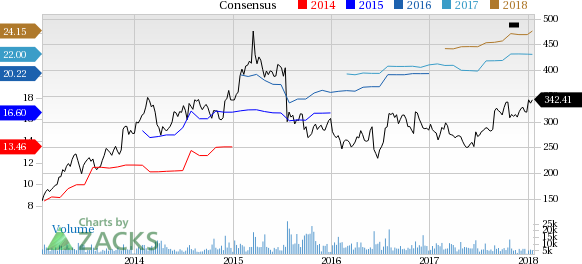

Biogen (BIIB) Q4 Earnings Miss, Sales Top, Stock Up

Cambridge, MA-based Biogen Inc. (NASDAQ:BIIB) holds a strong position in the multiple sclerosis (MS) market with a wide range of products including Avonex, Tysabri, Tecfidera and Plegridy. However, as competition in the MS market intensifies, Biogen is trying to diversify beyond MS to other areas like Alzheimer's, Parkinson's, stroke, among others. Meanwhile, in Feb 2017, the company spinned-off its hemophilia business which allows it to focus on neurology, its key area of expertise.

BIIB has a pretty good earnings track record with the company delivering positive earnings surprises in each of the last four quarters with an average surprise of 8.09%.

Currently, Biogen has a Zacks Rank #3 (Hold), but that could definitely change following the company’s earnings report which was just released. We have highlighted some of the key stats from this just-revealed announcement below:

Earnings Miss: Biogen’s fourth quarter 2017 earnings missed expectations. The company posted earnings of $5.26 per share while our consensus called for EPS of $5.44.

Revenues Beat: Biogen posted revenues of $3.31 billion, beating the consensus estimate of $3.07 billion. Revenue increased 15% year over year.

Key Statistics: Oral MS drug Tecfidera sales increased 7% year over year and 1% sequentially to $1.08 billion. The other MS drug, Tysabri’s sales decreased 2% year over year and 1% sequentially.

Pre-Market Trading: Shares were up more than 3% in pre-market trading.

Check back later for our full write up on this BIIB earnings report later!

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Biogen Inc. (BIIB): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.