- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

BioDelivery (BDSI) Q4 Earnings And Revenues Beat Estimates

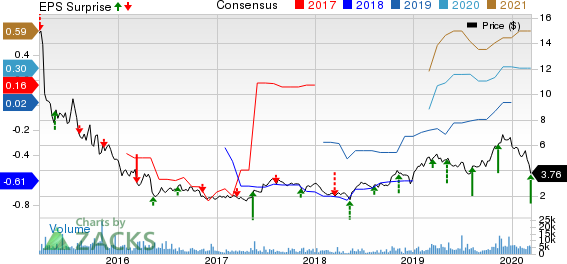

BioDelivery Sciences International, Inc. (NASDAQ:BDSI) recorded adjusted earnings of 6 cents per share for fourth-quarter 2019, which beat the Zacks Consensus Estimate of loss of a cent. In the year-ago quarter, the company had incurred an adjusted loss of 7 cents per share.

Revenues totaled $31.6 million, up 75.6% from the year-ago period and 4.3% sequentially. Sales also outpaced the Zacks Consensus Estimate of $31.26 million. The uptick was mainly driven by higher sales of Belbuca and the addition of Symproic tablets to its portfolio. The company added Symproic to its portfolio by acquiring U.S. commercial rights to the drug from Japan-based pharma company, Shionogi, in April 2019.

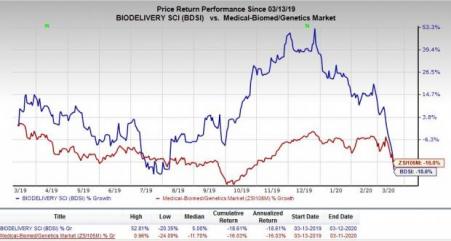

In the past year, shares of BioDelivery have declined 18.6% compared with the industry’s 16% decrease.

Quarter in Detail

BioDelivery’s marketed portfolio included Belbuca for chronic pain, Bunavail for treating opioid dependence and Symproic for opioid-induced constipation. The company announced the discontinuation of marketing of Bunavail earlier this month.

Belbuca, generated revenues of $28.3 million in the quarter, up 6.8% sequentially. On a year-over-year basis, the top line soared 78%. Sales of the drug have been witnessing a strong uptrend since 2018. Notably, the company re-acquired worldwide rights to the drug in early 2017 from Endo International (NASDAQ:ENDP) .

BioDelivery recorded Belbuca prescriptions of more than 96,000 for the quarter, representing a prescription volume growth of more than 70% in the quarter. This was the highest ever year over year growth for any three-month period.

Symproic sales in the fourth quarter were $2.7 million, up 22.7% sequentially. Total Symproic prescriptions during the quarter were 16,555, which reached an all-time high and represented more than 36% growth from the prior-year period.

Sales of Bunavail, indicated for the treatment of opioid dependence, were negative $0.5 million in the fourth quarter, compared to $1.2 million in the year-ago quarter. Negative sales of the drug during the quarter were due to one-time costs related to its discontinuation.

Product Royalty revenues in the fourth quarter were $1.2 million compared with $1 million in the year-ago period.

2019 Results

BioDelivery reported total revenues of $111.4 million, up 100% year over year. Adjusted earnings for the full year were 16 cents per share against an adjusted loss of 34 cents in 2018. Belbuca sales were up 112% year over year.

Zacks Rank & Other Key Picks

BioDelivery currently carries a Zacks Rank #2 (Buy).

A couple of other stocks to consider from the biotech sector are Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN) and Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) . While Regeneron sports a Zacks Rank #1 (Strong Buy), Vertex carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Regeneron’s earnings estimates have moved up from $26.83 to $28.73 for 2020 and from $28.09 to $30.20 for 2021 in the past 60 days. The company delivered a positive earnings surprise in three of the trailing four quarters, with the average beat being 1.44%. Share price of the company has increased 5.6% in the past year.

Vertex’s earnings estimates have moved up from $6.68 to $7.57 for 2020 and from $8.61 to $9.62 for 2021 in the past 60 days. The company delivered a positive earnings surprise in all the trailing four quarters, with the average beat being 21.76%. Share price of the company has increased 9.9% in the past year.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Endo International plc (ENDP): Free Stock Analysis Report

Regeneron Pharmaceuticals, Inc. (REGN): Free Stock Analysis Report

Vertex Pharmaceuticals Incorporated (VRTX): Free Stock Analysis Report

BioDelivery Sciences International, Inc. (BDSI): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

More than a century ago, then-Representative William McKinley pursued an aggressive tariff strategy that sought to protect American industry and reduce reliance on foreign...

Early in 2025, value stocks emerged as a popular choice among investors seeking market-beating returns. However, factor-based investing strategies can be notoriously difficult to...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.