- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Bear Of The Day: Diamondback Energy

I suppose you really don’t need me to point out any sort of Bear of the Day for you with so many stocks under pressure. It’s upsetting, even to the most seasoned stock market vets. Still, there are concerning earnings trends that need to be brought to light. It is the Zacks Rank which helps uncover these earnings trends. Zacks aggregates earnings estimates from all over Wall Street and uses these numbers to find stocks with the strongest, and the weakest trends. Stocks with the weakest earnings trends fit into the notorious Zacks Rank #5 (Strong Sell) category.

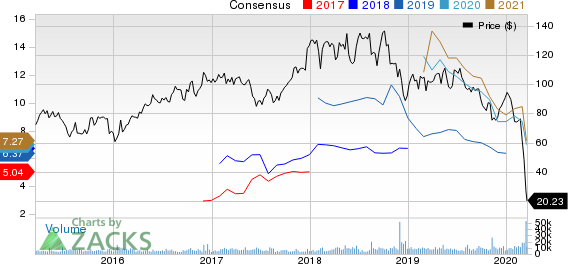

Today’s Bear of the Day is Zacks Rank #5 (Strong Sell) Diamondback Energy (FANG). Diamondback Energy, Inc., an independent oil and natural gas company, focuses on the acquisition, development, exploration, and exploitation of unconventional and onshore oil and natural gas reserves in the Permian Basin in West Texas. It primarily focuses on the development of the Spraberry and Wolfcamp formations of the Midland basin; and the Wolfcamp and Bone Spring formations of the Delaware basin, which are part of the Permian Basin in West Texas and New Mexico.

Oil prices remain under pressure as an all-out supply war wages between the Saudis and Russians. During the March 17th trading session, crude prices came down to under $27 per barrel. That’s obviously put oil production and exploration companies behind the eight ball. This disturbing trend began weeks ago, with analysts already revising their numbers to the downside.

Over the last sixty days, twelve analysts have lowered their earnings estimates for the current year, while seven analysts have dropped their numbers for next year. The negative revisions have had a drastic impact on our Zacks Consensus Estimate. The current year number has come down from $9.24 to $7.44. Nest year’s number has dropped from $9.70 to $8.37.

To be fair, eventually the valuations here have to become attractive. There is still earnings growth forecast year-over-year for next year. Current P/E is all the way down at 3.16x. That’s below the industry average of 5x and well below the market’s average of 14.64.

Investors looking for other stock ideas within the same industry have several names to check out. Among them are two Zacks Rank #1 (Strong Buy) stocks. Those are Antero Resources (AR) and Eclipse Resources (MR).

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Eclipse Resources Corporation (MR): Free Stock Analysis Report

Diamondback Energy, Inc. (FANG): Free Stock Analysis Report

Antero Resources Corporation (AR): Free Stock Analysis Report

Original post

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.