- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Baxter (BAX) Q4 Earnings Beat Estimates, Revenues In Line

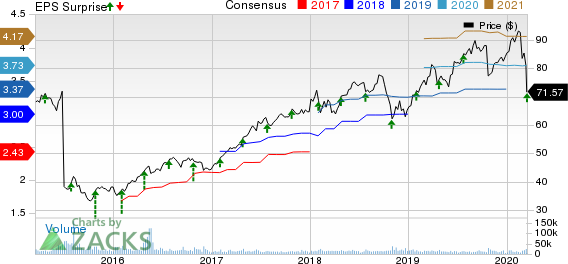

Baxter International Inc. (NYSE:BAX) reported fourth-quarter 2019 adjusted earnings of 97 cents per share, which surpassed the Zacks Consensus Estimate of 88 cents by 10.2%. The bottom line also improved 36.6% from the year-ago quarter.

For the full-year 2019, adjusted EPS came in at $3.31, up 13.7% from that of 2018. However, the figure missed the Zacks Consensus Estimate by 2.4%.

Revenues in Detail

Revenues of $3.04 billion matched the Zacks Consensus Estimate. The top line improved 7.3% year over year on a reported basis and 9% on operational basis.

For the full-year 2019, revenues totaled $11.36 billion, up 2.4% on a reported basis and 5% on an operational basis. The metric came in line with the Zacks Consensus Estimate.

Geographical Details

Baxter reports operating results through three geographic segments — Americas (North and South America), EMEA (Europe, Middle East and Africa) and APAC (Asia Pacific).

In Americas, Baxter reported revenues of $1.63 billion, up 9.4% on a year-over-year basis and 10% at constant currency (cc).

In EMEA, revenues totaled $789 million, up 3% from the year-ago quarter and 5% at cc.

In APAC, revenues of $618 million increased 7.5% from the prior-year quarter and 9% at cc.

Segmental Details

Renal Care

This segment reported revenues of $960 million in the quarter under review, up 0.9% year over year. Revenues at the segment increased 2% at cc.

Medication Delivery

Revenues at the segment grossed $775 million, up 17.8% from the year-ago quarter and 19% at cc.

Pharmaceuticals

Revenues at the segment amounted to $580 million, up 7.6% from the year-ago quarter and 9% at cc.

Clinical Nutrition

Revenues at the segment were $233 million, up 8.4% from the year-ago quarter and 10% at cc.

Advanced Surgery

Revenues at the segment totaled $231 million, up 8.5% from the year-ago quarter and 10% at cc.

Acute Therapies

This segment reported revenues of $144 million, up 5.9% from the prior-year quarter and increased 7% at cc.

Other

Revenues in the segment grossed $122 million, down 4.1% on a year-over-year basis and 3% at cc.

Margin Analysis

Baxter registered gross profit of $1.29 billion in the fourth quarter, up 9.7% year over year. As a percentage of revenues, gross margin expanded 90 bps on a year-over-year basis at 42.7% in the fourth quarter.

Operating income surged 37.1% year over year to $536 million in the quarter under review. As a percentage of revenues, operating margin expanded 380 bps to 17.6% in the fourth quarter.

Guidance

Due to the high-degree of uncertainty surrounding COVID-19 and any potential negative financial impacts from the same, Baxter is not issuing any guidance for full-year 2020. The company projects to provide an update in its first quarter 2020 earnings announcement on Apr 30, 2020.

For first-quarter 2020, the company anticipates sales growth in the range of 4-5% on a reported basis, and 5-6% on both cc and operational basis.

Adjusted earnings are projected to be in the range of 72-74 cents per diluted share. The Zacks Consensus Estimate is pegged at 81 cents.

Summing Up

Baxter ended fourth-quarter 2019 on a mixed note, with earnings beating the Zacks Consensus Estimate while revenues matching the same. The stock continues to benefit from its core Renal Care, Medication Delivery, Clinical Nutrition, Advanced Surgery, Pharmaceuticals and Acute Therapies units.

Growth in APAC buoys optimism. The company introduced the Sharesource 2.0 clinical portal that will offer the healthcare providers better insights to patients’ home PD treatments while offering improved clinic workflow. Further, the company acquired Cheetah Medical that will help in the expansion of Baxter’s presence in the specialized patient monitoring space. The company witnessed expansion in both gross and operating margins in the quarter under review.

Moreover, Baxter initiated the U.S. and Canadian launches of its next-generation PrisMax system for continuous renal replacement therapy (CRRT) and therapeutic plasma exchange (TPE). Additionally, the company received FDA approval for faster preparation of Floseal Hemostatic Matrix. Additionally, the company introduced Clinolipid (20% Lipid Injectable Emulsion), which is Baxter’s proprietary olive oil-based lipid emulsion, in the United States.

Meanwhile, Baxter’s Other unit witnessed sluggishness in the quarter under review. Also, cut-throat competition in the MedTech markets is indicative of dull prospects.

Zacks Rank

Baxter currently carries a Zacks Rank #3 (Hold).

Earnings of Other MedTech Majors at a Glance

Some better-ranked stocks that reported solid results this earning season are Stryker Corporation (NYSE:SYK) , Accuray Incorporated (NASDAQ:ARAY) and IDEXX Laboratories, Inc. (NASDAQ:IDXX) , each carrying a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stryker delivered fourth-quarter 2019 adjusted EPS of $2.49, outpacing the Zacks Consensus Estimate by 1.2%. Fourth-quarter reported revenues of $4.13 billion surpassed the Zacks Consensus Estimate by 0.7%.

Accuray reported second-quarter fiscal 2020 adjusted earnings per share (EPS) of a penny, beating the Zacks Consensus Estimate of a loss of 7 cents. Net revenues of $98.8 million outpaced the Zacks Consensus Estimate by 0.3%.

IDEXX Laboratories reported fourth-quarter 2019 adjusted EPS of $1.04, which beat the Zacks Consensus Estimate of 91 cents by 14.3%. Revenues were $605.4 million, surpassing the Zacks Consensus Estimate by 0.9%.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Stryker Corporation (SYK): Free Stock Analysis Report

Accuray Incorporated (ARAY): Free Stock Analysis Report

Baxter International Inc. (BAX): Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.