We are losing our nation and our future literally right before our eyes. WAKE UP, America!!

Who is involved in the greatest theft ever undertaken on American soil? All those involved in the scheme and scandal collectively defined as financial regulatory capture. Who are the parties to this scandal?

1. Politicians more concerned with re-election and collecting the needed campaign funding than actually pursuing the truth and principles needed to protect investors and the public at large.

2. Wall Street firms providing the funds to pay off the pols.

3. Regulators allowing themselves to ‘play the game’ or ‘play the fool’ if you’d like and get ‘captured.’

But there is one more factor in the mix and it is VERY important to achieve the capture and cripple the nation in the process? What is it?

4. A fully compliant media. You do not think so? For ample evidence of this factor in ‘the capture’, we need look no further than the coverage of the single greatest financial scandal in the history of our nation. Media Matters highlights,

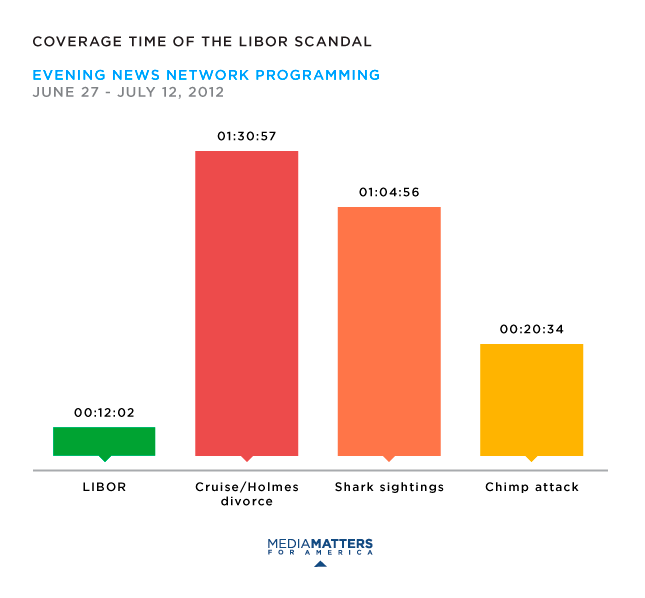

Instead of covering one of the largest banking scandals in history, American television news outlets have focused on the divorce of Tom Cruise and Katie Holmes, shark sightings, and a chimpanzee attack.

Last week, we documented how television news outlets are practically ignoring an emerging controversy over whether major financial institutions have been manipulating the LIBOR, a key interest rate banks use to borrow money from each other that is ”used as a benchmark to set payments on about $800 trillion worth of financial instruments.” MIT professor of finance Andrew Lo told CNN Money that the LIBOR-manipulation story “dwarfs by orders of magnitude any financial scams in the history of markets.”

In the fifteen days after news broke that U.S. and U.K. regulators had fined British multinational bank Barclays $450 million for its role in trying to rig the LIBOR, ABC, CBS, NBC, CNN, Fox News, and MSNBC spent only 12 minutes combined reporting on the story during their evening newscasts and opinion programming.

I thank the regular reader who provided this story.

WAKE UP America.

Perhaps readers may care to share this story with media outlets and let them know they are missing out on the biggest financial story . . . . EVER.

For those interested in reading more of this single greatest financial scandal in the history of our nation and in defense of our nation, I submit. .

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Barclays Libor Scandal: Wake Up, America!!

Published 07/22/2012, 03:49 AM

Updated 07/09/2023, 06:31 AM

Barclays Libor Scandal: Wake Up, America!!

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.