- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

BancorpSouth's (BXS) Q4 Earnings Beat Estimates, Costs Down

BancorpSouth (NYSE:BXS) reported fourth-quarter 2017 adjusted operating earnings of 42 cents per share, beating the Zacks Consensus Estimate of 41 cents. Also, the bottom line compared favorably with the year-ago quarter earnings of 40 cents.

Results benefitted from an improvement in net interest revenues and lower expenses, partially offset by lower non-interest revenues. Loans and deposit balances remained strong during the quarter. Further, the company recorded lower provisions in the quarter, which was a tailwind.

Including mortgage servicing rights valuation adjustment and considering expenses from the tax reform, the company’s net income for the quarter amounted to $37.5 million or 41 cents per share compared with $37.7 million or 40 cents reported in the year-ago quarter.

For 2017, BancorpSouth reported net income of $153 million or $1.67 per share compared with $132.7 million or $1.41 per share as of Dec 31, 2016.

Decline in Expenses, Partially Offset by Lower Revenues

Quarterly net revenues decreased nearly 1% year over year to $184.5 million. Also, the reported figure missed the Zacks Consensus Estimate of $187.1 million.

For 2017, the company reported revenues of $742.1million, up 1.9% on a year-over-year basis.

Net interest revenues came in at $121.4 million, up 5.2% year over year. Fully-taxable equivalent net interest margin (NIM) was 3.58%, increasing 12 basis points (bps) from the prior-year quarter.

Non-interest revenues decreased 12.4% year over year to $63.1 million. The decline was primarily due to a fall in mortgage banking revenues.

Non-interest expenses were $125.9 million, decreasing 3.6% on a year-over-year basis.

As of Dec 31, 2017, total deposits were $11.8 billion, upslightly sequentially while net loans and leases were flat at $10.9 billion.

Credit Quality Improves

Non-performing loans and leases were 0.71% of net loans and leases as of Dec 31, 2017, down from 0.94% as of Dec 31, 2016. Additionally, allowance for credit losses to net loans and leases was 1.07%, down from 1.14% registered in the comparable period last year. Further, non-performing assets were nearly $84.5 million, decreasing from $109.7 million registered in the prior-year quarter.

Annualized net charge-offs, as a percent of average loans and leases were 0.06% compared with 0.12% in the prior-year quarter. Also, the company recorded $0.5 million of provisions in the quarter compared with $1 million registered in the year-ago quarter.

Capital Ratios Deteriorate

As of Dec 31, 2017, Tier I capital and tier I leverage capital was 12.15% and 10.12%, down from 12.34% and 10.32%, respectively, at the end of the prior-year quarter.

The ratio of its total shareholders' equity to total assets was 11.20% at the end of the quarter, down from 11.71% as of Dec 31, 2016. The ratio of tangible shareholders' equity to tangible assets contracted 42 bps to 9.31%.

Share Repurchases

During the quarter, the company did not repurchasecommon shares. As of Dec 31, 2017, it had 6 million remaining shares available for repurchase under current share repurchase program through Dec 31, 2019.

Our Viewpoint

BancorpSouth reported a decent quarter. Improved NIM along with loan growth is likely to support its topline in the quarters ahead. Also, improving credit quality is a tailwind. Though, persistent decline in mortgage banking revenues continues to be a major concern, the company is well poised to benefit from lower tax rates and rising rate environment.

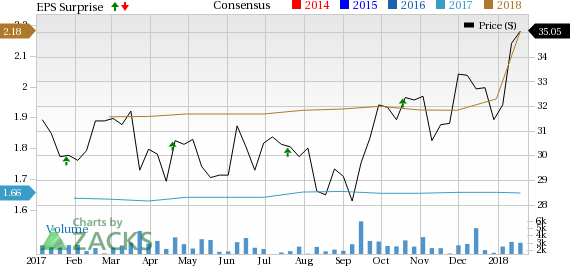

BancorpSouth, Inc. Price, Consensus and EPS Surprise

BancorpSouth carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of other Banks

Fifth Third Bancorp (NASDAQ:FITB) reported fourth-quarter 2017 adjusted earnings per share of 52 cents beating the Zacks Consensus Estimate of 47 cents. The adjusted figure excludes the impact of tax legislation, gain on the sale of Vantiv shares and charge related to the valuation of the Visa total return swap.

Shares of Webster Financial (NYSE:WBS) gained around 1% following its fourth-quarter 2017 earnings release. Adjusted earnings per share of 71 cents compared favorably with 60 cents earned in the prior-year quarter. The Zacks Consensus Estimate for the quarter’s earnings was 67 cents.

Driven by top-line strength, Northern Trust Corporation’s (NASDAQ:NTRS) fourth-quarter 2017 adjusted earnings per share of $1.51 compared favorably with $1.11 recorded in the year-ago quarter. Results include tax benefits and other one-time items. The Zacks Consensus Estimate was $1.30.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Fifth Third Bancorp (FITB): Free Stock Analysis Report

Northern Trust Corporation (NTRS): Free Stock Analysis Report

Webster Financial Corporation (WBS): Free Stock Analysis Report

BancorpSouth, Inc. (BXS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.