- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

AutoZone Drives On New Store Openings Despite Expense Woes

On Mar 12, we issued an updated research report on AutoZone, Inc. (NYSE:AZO) .

The company utilizes its strong cash position to open new stores every year. During second-quarter fiscal 2018, the company opened 35 new stores and closed one in the United States. The company also opened three new stores in Mexico and two in Brazil. As of Feb 10, the company had 5,514 stores across 50 states in the United States, the District of Columbia and Puerto Rico; 532 in Mexico; 26 Interamerican Motor Corp. branches and 16 stores in Brazil.

In the fiscal second quarter (ended Feb 10, 2018), the company reported adjusted earnings per share of $4.23, missing the Zacks Consensus Estimate of $8.81. Revenues rose 5.4% year over year to $2.41 billion in the reported quarter. The figure also surpassed the Zacks Consensus Estimate of $2.39 billion.

The company is well placed to grow its sales further in fiscal 2018. In the first two quarters of fiscal 2018, revenues improved 5.2% year over year to $5 billion. During the same period, same-store sales results showed an improved performance.

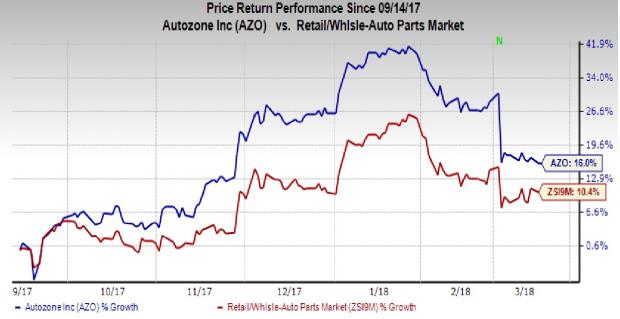

The company outperformed the industry it belongs to in the last six months. Its shares increased 16% compared with the industry’s growth of 10.4 %.

However, AutoZone’s plans of opening distribution centers are likely to escalate its capital and operating expenses over the next few years. The company is also investing in the development of mega-hub stores.

AutoZone currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

A few better-ranked stocks in the auto space are General Motors Company (NYSE:GM) , Volkswagen (DE:VOWG_p) AG (OTC:VLKAY) and AB Volvo (OTC:VLVLY) . While both General Motors and Volkswagen sport a Zacks Rank #1, AB Volvo carries a Zacks Rank #2.

General Motors has an expected long-term growth rate of 8.4%. Over the past year, shares of the company rose 2.3%.

Volkswagen has an expected long-term growth rate of 18.7%. The shares of the company gained 29.2% in the past year.

AB Volvo has an expected long-term growth rate of 15%. Over the past year, shares of the company rallied 32.6%.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year’s 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

General Motors Company (GM): Free Stock Analysis Report

Volkswagen AG (VLKAY): Free Stock Analysis Report

AutoZone, Inc. (AZO): Free Stock Analysis Report

AB Volvo (VLVLY): Free Stock Analysis Report

Original post

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.