- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Group 1 Automotive Buys Beadles, Gets A Dozen Dealerships

Group 1 Automotive Inc. (NYSE:GPI) has announced acquisition of Beadles Group Ltd., a U.K.-based automotive retailer. The acquired company has seven brands across 12 dealerships in the southeastern part of greater London metropolitan market.

The seven brands are Jaguar, Land Rover, Volkswagen (DE:VOWG_p), Skoda, Toyota, Vauxhall and Kia with their dealership sites located in the towns of Bromley, Coulsdon, Dartford, Maidstone, Medway, Sevenoaks, Sidcup and Southend.

The dealerships will continue to be managed under the Beadles name and are anticipated to generate roughly $330 million in annualized revenues.

The new acquisition will enable Group 1 Automotive to increase its operation in the U.K., with total dealership count reaching 43. Apart from the 12 newly added ones, the existing dealerships are of Audi, BMW/MINI, Ford, Jaguar, SEAT and Volkswagen Commercial Vehicles stores.

According to Earl J. Hesterberg, Group 1 Automotive’s president and CEO, the acquisition will support the company with scale, additional management resources as well as new brand partnerships in the U.K. The latest addition along with the current U.K. operations is expected to contribute over $2 billion in annualized revenues.

The company regularly acquires and divests dealerships and franchises to expand its business. The most recent dealership was in Apr 2017, when the company opened an add point in Austin, TX, thereby increasing the U.S. Nissan network to nine dealerships.

These add points are expected to rake in around $60 million in annual revenues. Earlier in Jan 2017, Group 1 Automotive had acquired a BMW motorcycle franchise in Parana, Brazil.

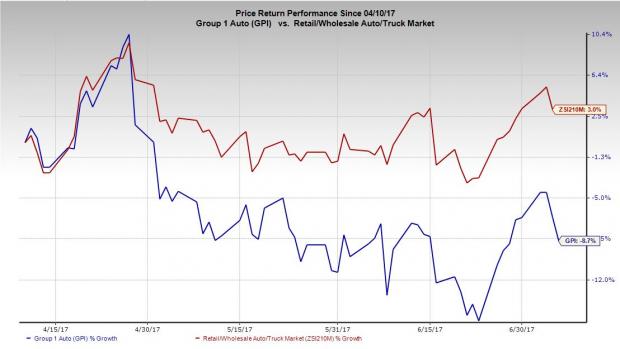

Price Performance

Group 1 Automotive has underperformed the Zacks categorized Automotive - Retail and Whole Sales industry in the last three months. The company’s shares have lost 8.7% during this period compared with a the industry gain of 3%.

Zacks Rank & Key Picks

Currently, Group 1 Automotive carries a Zacks Rank #3 (Hold).

Some better-ranked automobile stocks are Allison Transmission Holdings, Inc. (NYSE:ALSN) , Continental AG (OTC:CTTAY) and Cummins Inc. (NYSE:CMI) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Allison Transmission Holdings has an expected long-term growth rate of 11%.

Continental has expected long-term earnings per share growth rate of 7.8%.

Cummins has an expected earnings growth rate of 11.7% over the long term.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Group 1 Automotive, Inc. (GPI): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Cummins Inc. (CMI): Free Stock Analysis Report

Continental AG (CTTAY): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.