- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Is Samsung (SSNLF) Working On A Bixby-Powered AI Speaker?

Citing sources familiar with the matter, The Wall Street Journal (WSJ) reported that South Korean tech giant, Samsung Electronics (KS:005930) Co Ltd. (SSNLF) is working on a Bixby-powered artificial intelligence (AI) speaker, codenamed Project Vega. The details of the product and launch timings aren’t clear as of now. Moreover, Samsung has refrained from commenting on the matter.

Per WSJ, Vega is in the works since last one year. The project has been marred by delay in launch of the English version of its digital voice assistant, Bixby, the report added.

Samsung unveiled Bixby in March this year along with the Galaxy S8 and S8+ phones. The company stated "Bixby is at the heart of our software and services evolution as a company."

A few days back, Samsung’s arch rival in the smartphone space, Apple Inc (NASDAQ:AAPL) , unveiled the Siri-integrated HomePod. With the device, Apple is preparing itself to take on Amazon’s (NASDAQ:AMZN) Echo and Alphabet’s Google (NASDAQ:GOOGL) Home.

Samsung’s entry in the field will be highly difficult against established players like Echo and Google Home. Moreover, the launch of HomePod this December will also add to its woes.

Per a recent report from eMarketer, Echo is the most popular voice-controlled speaker so far and is expected to maintain its supremacy in 2017.

The report stated that the number of Americans using home assistants is expected to more than double this year. It added that Amazon will have above 70% of the total voice-enabled speaker users in the U.S. this year. Meanwhile, Google Home is expected to account for 23.8%, while other smaller players like Lenovo, LG, Harmon Kardon and Mattel (NASDAQ:MAT) would account for only 5.6% of the total users.

In a separate development, Reuters reported that Samsung has said that it will invest about $18.6 billion in South Korea to “extend its lead in memory chips and next-generation displays for smartphones.” Samsung will be allocating a chunk of this investment toward its new NAND factory in Pyeongtaek and also invest in the new semiconductor production facility in Hwaseong. The company is also looking to create about 440K domestic jobs by 2021.

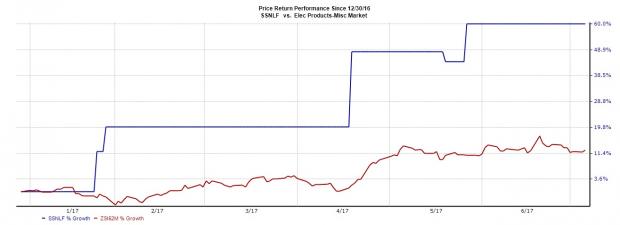

Also, per a Thomson Reuters survey, Samsung is expected to report a 67% jump in its operating profit to $11.4 billion for the April-June quarter, buoyed by sale of memory chips as well as solid sales of S8. Year to date, shares of Samsung have widely outperformed the Zacks categorized Electronic products Miscellaneous Products industry. While the industry gained 12.5%, Samsung shares have surged 60%.

Stocks to Consider

Stocks worth considering in the broader tech space include Quantum Corporation (NYSE:QTM) and Marvell Technology Group Ltd. (NASDAQ:MRVL) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Quantum and Marvell have delivered average positive earnings surprise of 43.75% and 86.70%, respectively in the trailing four quarters.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2%, respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

Quantum Corporation (QTM): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Marvell Technology Group Ltd. (MRVL): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.