Armstrong World Industries, Inc. (NYSE:AWI) posted adjusted earnings of 86 cents per share in third-quarter 2017, which increased 14.7% year over year. Earnings, however, missed the Zacks Consensus Estimate of 92 cents.

Including one-time items, the company reported earnings per share of 81 cents compared with 99 cents recorded in the prior-year quarter.

Operational Update

Net sales increased 5.1% year over year to $351.9 million. Excluding the unfavorable impact from foreign exchange of $5 million, net sales were up 3.7%, attributed to elevated volumes and higher average unit values (AUV). Nevertheless, revenues fell short of the Zacks Consensus Estimate of $356 million.

Cost of sales climbed 7% year over year to $241 million. Gross profit inched up 1.1% to $110.9 million in the reported quarter.

Selling, general and administrative (SG&A) expenses were up 0.2% year over year to $55.8 million. Adjusted operating income improved 9.2% year over year to $83 million driven by improvements in AUV and lower SG&A expenses.

Segment Performance

Americas: Net sales at the Americas segment grew 3.5% year over year to $233.8 million. Operating income edged down 1.5% to $67.6 million in the third quarter from $68.6 million reported in the prior-year quarter.

EMEA: The EMEA segment’s sales were up 3.1% year over year to $76.5 million from $74.2 million recorded in the year-ago quarter. The segment’s operating profit dropped 7.3% year over year to $3.8 million.

Pacific Rim: Net sales in the reported quarter jumped 20% year over year to $41.6 million. The segment posted a loss of $2.4 million, against earnings of $1 million reported in the previous quarter.

Financials

Armstrong World reported cash and cash equivalents of $116.5 million as of Sep 30, 2017, compared with $142.5 million as of Sep 30, 2016. The company recorded cash flow from operations of $104.9 million for the nine-month period ended Sep 30, 2017, compared with usage of $2.6 million in the comparable period last year.

Outlook

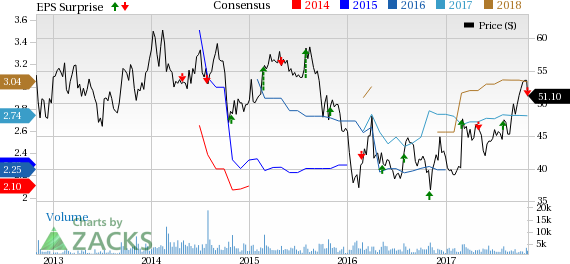

Armstrong World raised its 2017 adjusted earnings per share guidance range to $2.80-$2.90 from the prior band of $2.65-$2.75. The improvement reflects net benefit of the environmental insurance settlement this October.

Share Price Performance

In the last year, Armstrong World has outperformed the industry with respect to price performance. The stock has gained around 39.2%, while the industry recorded growth of 32%.

Zacks Rank & Key Picks

Armstrong World currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the same sector are BELLWAY (OTC:BLWYY) , United Rentals, Inc. (NYSE:URI) and Owens Corning (NYSE:OC) . BELLWAY and United Rentals flaunt a Zacks Rank of 1 (Strong Buy), while Owens Corning carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BELLWAY has an expected long-term earnings growth rate of 9.8%.

United Rentals has an expected long-term earnings growth rate of 15.6%.

Owens Corning has an expected long-term earnings growth rate of 14.8%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

United Rentals, Inc. (URI): Free Stock Analysis Report

Armstrong World Industries Inc (AWI): Free Stock Analysis Report

Owens Corning Inc (OC): Free Stock Analysis Report

BELLWAY (BLWYY): Free Stock Analysis Report

Original post