Arconic (NYSE:ARNC) said that it has wrapped up the early redemption of all its 6.50% bonds due 2018 and 6.75% notes due 2018 in the total principal amount of roughly $100 million and $344.8 million, respectively.

Holders of the 6.50% bonds were paid $1,049.99 per $1,000 total principal amount of the bonds, or $105.1 million, along with accrued and unpaid interest. Holders of the 6.75% notes got $1,054.26 per $1,000 total principal amount of the notes, or $363.5 million, along with accrued and unpaid interest.

The redemptions are part of the company’s de-leveraging program. The actions taken by Arconic so far in 2017 have resulted in a reduction of its total debt by around $1.25 billion.

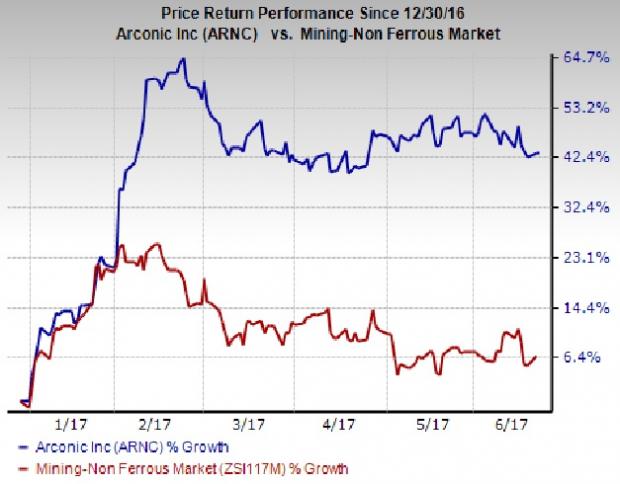

Arconic has outperformed the Zacks categorized Mining-Non Ferrous industry year to date, aided by strong demand for its products across aerospace and automotive markets and its efforts to improve cost structure through company-wide productivity actions. The company’s shares have gained around 43.5% over this period, compared with roughly 6.7% gain recorded by the industry.

Arconic is seeing healthy demand trends in the aerospace market. The company is well placed to gain from major contract wins in aerospace. Arconic is also well positioned to capture the growing demand for aluminum sheet stemming from the transition of the North American auto industry to lightweighting.

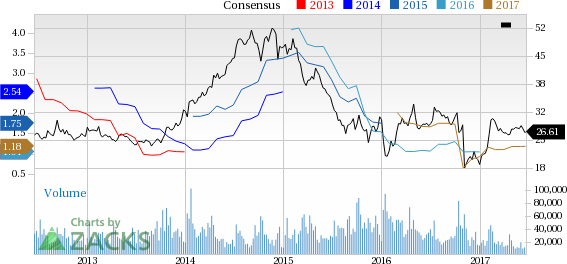

Arconic also remains focused on capital efficiency, growth actions, cost cutting and improving margin in 2017. The company’s cost reduction actions and productivity improvements across its businesses should lend support to its bottom line this year. The company sees revenues in the range of $11.8 billion to $12.4 billion and adjusted earnings of $1.10 to $1.20 per share for 2017.

Arconic is a Zacks Rank #2 (Buy) stock.

Other Stocks to Consider

Other well-placed stocks in the basic materials space include Huntsman Corporation (NYSE:HUN) , BASF SE (OTC:BASFY) and The Chemours Company (NYSE:CC) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Huntsman has an expected long-term earnings growth of 7%.

BASF has an expected long-term earnings growth of 8.9%.

Chemours has an expected long-term earnings growth of 15.5%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana. Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

BASF SE (BASFY): Free Stock Analysis Report

Huntsman Corporation (HUN): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Arconic Inc. (ARNC): Free Stock Analysis Report

Original post

Zacks Investment Research