ArcelorMittal (NYSE:) issued €500 million 0.95% fixed rate notes due Jan 17, 2023. The notes were issued under the company’s €10-billion wholesale Euro Medium Term Notes (EMTN) program.

The company noted that the net proceeds from the notes issue will be used for general corporate purposes, including the refinancing of existing debt.

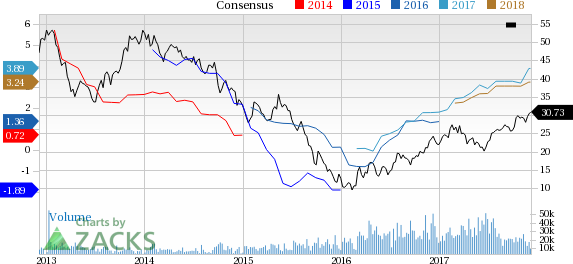

ArcelorMittal’s shares have moved up 14.5% in the last three months, outperforming the

industry’s 4.1% gain.

ArcelorMittal, during third-quarter earnings call, said that market conditions are favorable and demand environment remains positive along with healthy steel spreads. The company continues to expect global apparent steel consumption to grow in the range of 2.5-3% for 2017.

In the United States, the company sees apparent steel consumption growth of 2-3% in 2017, factoring in higher construction and machinery demand, offset by lower production in the automotive. The company also anticipates 0.5-1.5% growth in apparent steel consumption in Europe. Moreover, apparent steel consumption is forecasted to rise 2-3% in Brazil as sustained weakness in construction is partly offset by modest improvement in consumer confidence and automotive demand. Apparent steel consumption in China is expected to grow 2.5-3.5% for 2017, owing to strength in automotive and machinery.

ArcelorMittal should gain from its efforts to reduce debt. It also remains on track with its cost-reduction actions under Action 2020 program that includes plans to optimize costs and increase steel shipment volumes.

The company is also expanding its global portfolio of automotive steels by launching a new generation of advanced high strength steels. The launch of these steels is in sync with the company’s Action 2020 program that aims to achieve targeted financial improvements for the company by 2020.

ArcelorMittal Price and Consensus

ArcelorMittal Price and Consensus | ArcelorMittal Quote

Zacks Rank & Stocks to Consider

ArcelorMittal currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Kronos Worldwide Inc. (NYSE:) , Koppers Holding Inc. (NYSE:) and Westlake Chemical Corporation (NYSE:) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Kronos Worldwide has expected long-term earnings growth of 5%. Its shares have gained 103.5% year to date.

Koppers has expected long-term earnings growth of 18%. Its shares have rallied 21.6% year to date.

Westlake Chemical has expected long-term earnings growth of 10.6%. Its shares have moved up 74.5% year to date.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.