- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Applied Materials Hits New 52-Week High On Strong Q1 Results

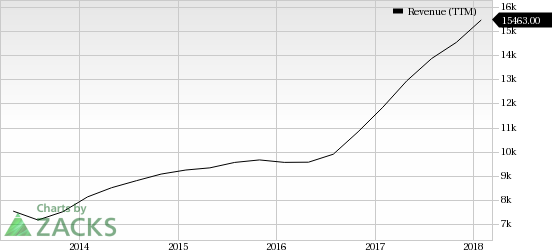

Shares of Applied Materials, Inc. (NASDAQ:AMAT) rallied to a new 52-week high of $61.76, eventually closing a tad bit lower at $61.61 on Mar 9.

The momentum can be attributed to the company’s impressive first-quarter fiscal 2018 results. Applied Materials reported pro-forma earnings of $1.06 per share, up 59% year over year. Revenues of $4.2 billion, increased 28.2% on a year-over-year basis, which was driven by product portfolio strength.

Since Feb 14 (first-quarter earnings release date) the stock has gained 18.6%, outperforming the industry’s rally of 14.6%. We believe that Applied Materials strong pipeline of enabling technologies along with emerging trend in semiconductors and display areas will drive growth in 2018.

Currently, Applied Materials sports a Zacks Rank #1 (Strong Buy) and has a market capital of $54.72 billion.

.jpg)

Robust Product Portfolio

Applied Materials has a well-differentiated product portfolio, which helps the company to maintain a strong market position.

Strong efforts to expand beyond semiconductors, especially in display, have benefited the company. Introduction of Gen 10.5 for televisions and organic LED displays for mobiles have new opened new growth avenues for the company.

Further, the company’s focus on patterning, inspection and metrology remains positive for gaining market share. In patterning, Applied Materials offer materials-enabled solutions to customers.

In inspection and metrology market E-Beam is experiencing increasing adoption, which bodes well for the company.

Technological Advancement

Applied Materials continues to benefit from technological advancements in semiconductor and display fronts. Moreover, rising demand for semiconductors and displays aided by the emergence of Internet of Things (IoT), big data and artificial intelligence, cloud infrastructure, virtual reality and smart vehicles, is a tailwind.

Further, the company is well positioned for NAND supply which is required for the growing data storage market. Applied Materials’ market share has gained significantly with its strength in 3D NAND, DRAM and patterning. Management expects increasing DRAM and logic spending in 2018.

Estimate Revisions Positive

Additionally, the company witnessed an upward revision in its earnings estimates in last 30 days. The Zacks Consensus Estimate for fiscal 2018 and 2019 is currently pegged at $4.39 and $4.55, respectively.

Stocks to Consider

Investors interested in the broader technology sector can consider Lam Research Corporation (NASDAQ:LRCX) , Advanced Energy Industries (NASDAQ:AEIS) and ASML Holding (NASDAQ:ASML) . While Lam Research sports a Zacks Rank #1, Advanced Energy Industries and ASML Holding carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Lam Research, Advanced Energy Industries and ASML Holding are currently pegged at 14.85%, 9% and 18.65%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

ASML Holding N.V. (ASML): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Advanced Energy Industries, Inc. (AEIS): Free Stock Analysis Report

Original post

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.