- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Applied Industrial (AIT) Declines 52% YTD: What's Hurting It?

Shares of Applied Industrial Technologies, Inc. (NYSE:AIT) have plunged sharply since the beginning of 2020. We believe that the price decline reflects investors’ reaction to the company’s lackluster second-quarter fiscal 2020 (ended Dec 31, 2019) results and its dismal projections for fiscal 2020 (ending June 2020).

The Cleveland, OH-based company belongs to the Zacks Manufacturing – General Industrial industry, which, in turn, comes under the ambit of the Zacks Industrial Products sector. The industry is currently at the bottom 33% (with the rank of 169) of more than 250 Zacks industries.

Year to date, the company’s shares have dipped 52% compared with the industry’s decline of 33.4% and the sector’s fall of 35%. Notably, the S&P 500 has declined 25.4% during the same period.

The company currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Factors Affecting the Stock

So far in 2020, Applied Industrial has reported mixed results for second-quarter fiscal 2020. Earnings in the quarter were in line with estimates, while sales lagged the same by 0.1%. On a year-over-year basis, organic sales declined 4% due to soft customer activities in December. Also, the company recorded weak results in machinery, metals, mining and other end-markets.

In addition to the lackluster performance, weak projections provided by Applied Industrial must have added to the bearish sentiments for the stock. Uncertain end-market conditions are predicted to adversely impact the company’s performance in fiscal 2020.

Sales in the year will likely be between a 2% decline and flat year over year, with organic sales down 3-5%. The projections compare unfavorably with the previously mentioned 2% decline to 2% growth in sales and a 1-5% decline in organic sales. Additionally, the company expects organic sales to fall in mid-single digits in the fiscal third quarter (ending March 2020) and decline in low-single digits in the fourth quarter (ending June 2020).

Segmental performances are predicted to be weak in the second half of fiscal 2020. Organic sales are likely to be in mid- to low-single digits for the Service Center-Based Distribution segment and decline in low-single digits for the Fluid Power & Flow Control segment.

Also, the company’s earnings per share are predicted to be $420-$4.40 in fiscal 2020 compared with $4.20-$4.50 mentioned previously. Notably, its earnings were $4.41 per share in fiscal 2019 (ended June 2019). Interest expenses will likely be at the higher end of $37-$38 million stated previously.

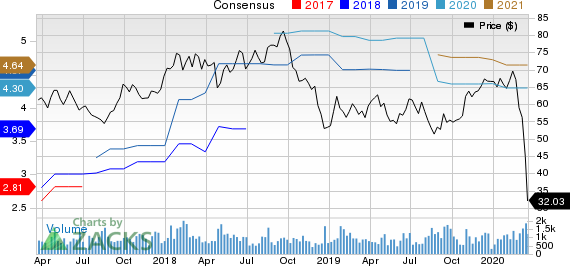

Currently, the Zacks Consensus Estimate for Applied Industrial’s earnings is pegged at $4.30 for fiscal 2020 and $4.65 for fiscal 2021 (ending June 2021), marking declines of 1.6% and 1.7% from the respective 60-day-ago figures. Notably, there were two downward revisions in estimates for fiscal 2020 and 2021. No upward revision in estimates has been recorded for the fiscal years in the past 60 days.

Applied Industrial Technologies, Inc. Price and Consensus

Applied Industrial Technologies, Inc. (AIT): Free Stock Analysis Report

Kaman Corporation (KAMN): Free Stock Analysis Report

Nordson Corporation (NDSN): Free Stock Analysis Report

Tennant Company (TNC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.