Apple’s (NASDAQ:AAPL) assembly partner, Pegatron is reportedly planning to set up production facilities in Vietnam.

Per Bloomberg, the Taiwan based company is looking for a site in North Vietnam to build a brand-new facility. Moreover, Pegatron has already rented a separate facility in Haiphong to make styluses for Samsung’s (OTC:SSNLF) smartphones.

Pegatron will become the third iPhone assembler, joining Wistron Corp and Hon Hai Precision Industry Co, to set up manufacturing facilities in Vietnam.

Pegatron is likely to assemble iPhones at its Vietnam facility. Moreover, other assembly partners making Apple products in Vietnam includes GoerTek, which manufactures AirPods in the country.

New Facilities Expected to Aid Apple

The two-year long U.S.-China trade war has forced electronics companies to look for alternate production bases, given the high tariffs imposed on China. The tensions between the two countries have also negatively impacted Apple’s supply chain.

Hence, production and assembly facilities in Vietnam are expected to aid the company in the long haul as it will diversify Apple’s global supply chain and assembly lines, thereby reducing dependence on China.

Notably, devices like Apple Watch and AirPods have been hit by tariffs related to the trade war. A tariff of 25% has also been placed on imported Mac Pro parts by the Trump administration.

Although the recent phase one trade deal between the United States and China has exempted core products like the iPhone, MacBook and iPad from tariffs, it essential to have a diversified supply chain as tensions between the countries is unlikely to fully subside in the near term.

Moreover, the tariffs which have already been imposed, including 25% tariffs on $250 billion of Chinese imported goods, are not likely to be eased until the completion of phase two of the U.S.-China trade agreement.

Services and Wearables to Drive Growth

Apple is expected to witness a decline in iPhone sales in the coming quarters due to the absence of a 5G iPhone as well as stiff competition from Chinese smartphone makers.

Although it acquired Intel’s (NASDAQ:INTC) smartphone modem business and settled its dispute with Qualcomm (NASDAQ:QCOM) to possibly launch a 5G iPhone in 2020, competitors like Samsung and Huawei already have 5G phones in the market.

However, Apple is expected to benefit from robust performance of its services and wearables business segments.

Notably, per a Sensor Tower report, Apple’s App Store brought in $54.2 billion in sales, up 16.3% year over year in 2019.

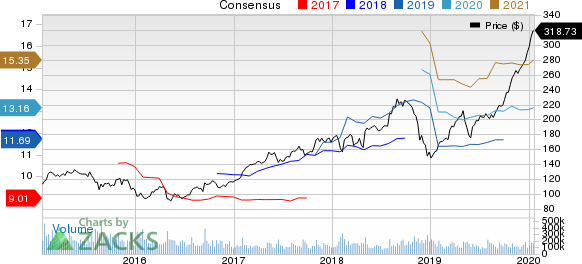

The Zacks Consensus Estimate for first-quarter fiscal 2020 revenues is pegged at $87.7 billion, indicating growth of 4% from the figure reported in the year-ago quarter.

Additionally, the consensus mark for earnings is pegged at $4.53 per share, up 0.4% over the past 30 days.

Zacks Rank

Apple currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Samsung Electronics (KS:005930) Co. (SSNLF): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

Original post