Just as the third quarter reporting season for the S&P 500 came to an end on Monday with H&R Block Inc (NYSE:HRB), AutoZone Inc (NYSE:AZO) (NYSE:AZO) kicked off the fourth quarter season after Tuesday’s closing bell. The automotive retailer announced earnings per share (EPS) of $7.27, well above the Estimize consensus of $7.22 and the Wall Street consensus of $7.18, resulting in year-over-year (YoY) growth of 16%. Revenues came in at $2.26B, beating Estimize and Wall Street expectations of $2.21B and increasing 8% YoY.

The company tied better-than-expected results not only to business improvements such as inventory availability, but also to lower gas prices and favorable weather during the quarter. Autozone’s report bodes well for retailers, especially those in the automotive space.

Costco ((NASDAQ:COST) also put up respectable results when they reported yesterday morning. EPS came in at $1.12, $0.02 higher than Estimize and $0.03 higher than Wall Street expectations, growing 17%. Revenues of $26.87B were a little lighter than the $26.98B that the Estimize community was looking for, but still above Wall Street’s $26.83B estimate. An increase in membership fee revenue, which rose to $582M from $549M year-over-year, helped to offset merchandise costs that rose by nearly 7%. Same store sales excluding negative impacts from gasoline price deflation and foreign exchange came in at 7% overall, with both the U.S. and international posting 7%. Costco should continue to do well in 2015 if it can keep growing membership fees at this pace, although there is no doubt they will receive considerable pressure from competitors such as Target (NYSE:TGT) and Sam’s Club, a division of Wal-Mart (NYSE:WMT).

Today we’ll be watching results from Adobe (NASDAQ:ADBE) the third S&P 500 component to report for Q4, as well as Lululemon (NASDAQ:LULU) which is not in the index and reporting for the third quarter.

What to Expect for the Fourth Quarter

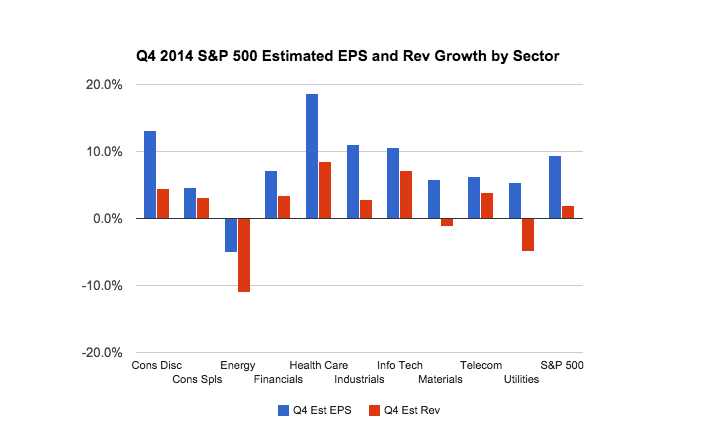

Expectations for S&P 500 earnings growth for the fourth quarter stand at 9.4%. Revenues are anticipated to come in with 2.0% growth. Energy is the only sector expected to post both negative earnings and revenue growth, while Materials and Utilities are estimated to post negative revenue growth only.