- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

American States Water (AWR) Q4 Earnings Top, Revenues Lag

American States Water Company (NYSE:AWR) delivered fourth-quarter 2017 earnings of 36 cents per share, surpassing the Zacks Consensus Estimate of 35 cents by 2.7%. Further, the figure improved by 20% from 30 cents in the year-ago period.

On a GAAP basis, American States Water’s reported earnings of 35 cents per share, up from 30 cents a year ago. The difference between GAAP and adjusted earnings was primarily due to the effects of the tax reform.

Total Revenues

The company’s operating revenues were $104.2 million, missing the Zacks Consensus Estimate of $109 million by 4.4%. Revenues dipped 2.4% year over year. Total revenues were down primarily due to lower revenues generated by Contracted Services segment.

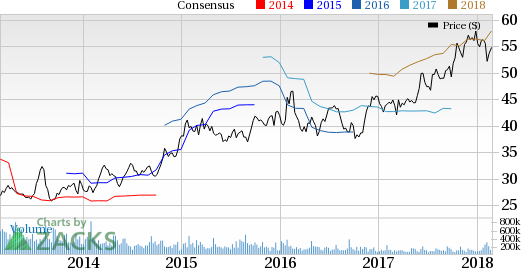

American States Water Company Price, Consensus and EPS Surprise

Operational Update

In the quarter under review, American States Water’s total operating expenses were $82.2 million, down 2.9% year over year.

Interest expenses were $4.9 million, down 1.2% year over year. Similarly interest income were $0.59 million, three fold increase year over year.

Segment Details

Earnings at Water segment were 21 cents, up 61.5% from 13 cents year over year.

Earnings at Electric segment were 2 cents, down 50% year over year.

Earnings at Contracted Services segments were 11 cents, down 15.4% compared with year-ago period.

Earnings at AWR (parent) were 2 cents, up 100% compared with prior-year period.

Financial Update

As of Dec 31, American States Water’s cash and cash equivalents were $0.21 million compared with $0.44 million in the year-ago period.

The company’s long-term debts remained flat at $321 million, compared with amount as of Dec 31, 2016.

In 2017, net cash from operating activities was $144.6 million, up from $96.9 million in the year-ago period.

Zacks Rank

American States Water currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Peer Releases

Connecticut Water Service, Inc. (NASDAQ:CTWS) is expected to release 2017 fourth-quarter earnings on March 12. The Zacks Consensus Estimate for the quarter is pegged at 21 cents.

Consolidated Water Co. Ltd. (NASDAQ:CWCO) is scheduled to release 2017 fourth-quarter earnings on March 15. The Zacks Consensus Estimate for the quarter is pegged at 18 cents.

Global Water Resource Inc. (NASDAQ:GWRS) is anticipated to release 2017 fourth-quarter earnings on March 9. The Zacks Consensus Estimate for the quarter is pegged at 1 cent.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

Connecticut Water Service, Inc. (CTWS): Free Stock Analysis Report

Consolidated Water Co. Ltd. (CWCO): Free Stock Analysis Report

American States Water Company (AWR): Free Stock Analysis Report

Global Water Resources, Inc. (GWRS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.