- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

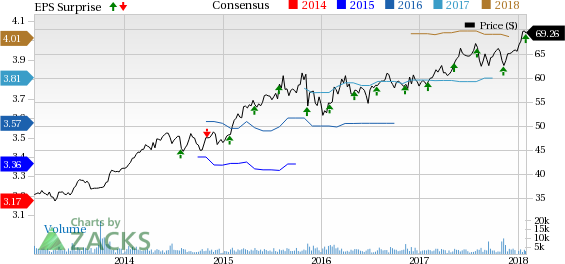

Amdocs (DOX) Beats On Q1 Earnings, Repeats FY18 EPS View

Amdocs Limited (NASDAQ:DOX) reported better-than-expected first-quarter fiscal 2018 (ended Dec 31, 2017) earnings.

During the conference call, the company announced that it has inked a deal to acquire Vubiquity Inc. against roughly $224 million. The buyout is likely to close by second-quarter fiscal 2018-end.

Earnings

Quarterly adjusted earnings came in at $1.06 per share, beating the Zacks Consensus Estimate of 97 cents. The bottom line also came in higher than the year-ago tally of 90 cents per share.

Revenues

Revenues in the reported quarter came in at $977.7 million, missing the Zacks Consensus Estimate of $979 million by a whisker. However, the top line came in 2.4% higher than the year-ago figure.

Top-Line Details

Customer Experience Systems revenues were $965.9 million in the reported quarter, up 3% year over year.Systems Directory revenues came in at $11.8 million, plunging 29.8% year over year.

Geographically, revenues from North America were $643 million, up 2.4% from the year-ago period. Europe recorded revenues of $133.7 million, up 12.8% year over year. Nonetheless, Rest of the World generated revenues of $201 million, down 3.5% year over year.

Margins

Cost of sales in the reported quarter was $643.2 million, up 3.6% year over year. Selling, distribution and administrative expenses totaled $118.7 million compared to $124.1 million incurred in the year-earlier period. Operating margin in the fiscal first quarter came in at 12.5%, contracting 20 bps year over year.

Balance Sheet & Cash Flow

Exiting the reported quarter, Amdocs had cash and cash equivalents of $965.9 million compared with 979.6 million recorded in the prior quarter.

In the first three months of fiscal 2018, the company generated net cash of $164.6 million from its operating activities compared to $168 million cash generated in the year-earlier period.

In the fiscal first quarter, Amdocs purchased property worth $51.8 million compared with $41.7 million property purchased at the end of first-quarter fiscal 2017.

During the reported quarter, the company purchased shares worth $120 million. Also, its board of directors has approved the payment of a quarterly dividend at an increased rate of 25 cents per share. The dividend will be paid on Apr 20 to shareholders on record as of Mar 30, 2018.

Outlook

Amdocs is poised to grow on the back of sturdy sales, robust backlog, well-planned acquisitions and strategic growth-focused investments. The company anticipates to report revenues in the range of $960-$1,000 million and adjusted earnings per share (EPS) in 91-97 cents per share in second-quarter fiscal 2018. The company reiterated its revenue and EPS growth view for fiscal 2018. For fiscal 2018, Amdocs expects adjusted EPS year-over-year growth of 4-8% on revenue growth of 0-4%.

Stocks to Consider

Some better-ranked stocks in the Zacks Categorized Computer and Technology Sectorare listed below:

AMTEK, Inc. (NYSE:AME) carries a Zacks Rank of 2 (Buy). The company pulled of an average positive earnings surprise of 4.14% in the last four quarters. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Applied Materials, Inc. (NASDAQ:AMAT) has a Zacks Rank of 2. The company generated an average positive earnings surprise of 2.82% during the same time frame.

Canon, Inc. (NYSE:CAJ) also holds a Zacks Rank of 2. The company pulled of an average positive earnings surprise of 17.90% over the preceding four quarters.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Amdocs Limited (DOX): Free Stock Analysis Report

Canon, Inc. (CAJ): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

AMETEK, Inc. (AME): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.