- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Amazon (AMZN) Leading Record-Breaking Start To Holiday Season

The holiday season has started off on a solid note this year. With retailers offering hefty discounts, online sales during Thanksgiving and Black Friday hit all-time highs.

Per GBH Insights, the retailer Amazon.com Inc. (NASDAQ:AMZN) dominated online sales during Black Friday and accounted for 45-50% sales. The company raked in more than $1 billion sales in just 24 hours. Amazon stated that on Thanksgiving day, orders via mobiles increased more than 50% than the year-ago period.

A Look at the Sales Figures

According to Adobe Analytics, U.S. retailers garnered $7.9 billion from Thanksgiving and Black Friday sales, up 17.9% year over year. While Thanksgiving sales increased 18.3% year over year to $2.9 billion, Black Friday sales increased 16.9% to $5 billion.

Further, Adobe expects Cyber Monday to be the biggest ever U.S. online shopping day with roughly $6.6 billion of sales. Per commerce marketing firm Criteo, purchases through mobile phones accounted for 40% of sales during Black Friday, up from 29% last year. The figure for Thanksgiving day was 46%, reflecting a 15% year-over-year increase, per Adobe.

According to retail analysts and consultants, laptops, toys TVs and gaming consoles, especially PlayStation 4 were among the heavily discounted as well as best-selling products.

Why is Amazon Stealing the Show?

Amazon offers around 480 million products of various brands, categories, genres and prices. Around 50 million products qualify for free two-day shipping to Prime members. Moreover, Prime Air, Trucks, pickup locations and artificial intelligence are all driving efficient logistics at Amazon. Fulfillment by Amazon (FBA) is also part of this.

Amazon.com, Inc. Net Income (TTM)

Most importantly, the Whole Foods acquisition is helping Amazon to deliver a great omnichannel experience and tap the growing number of online grocery shoppers.

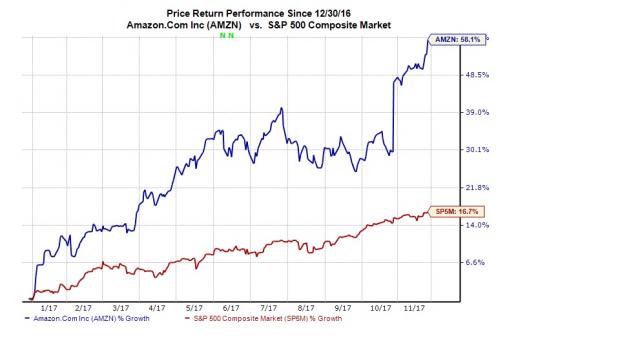

Shares of the Zacks Rank 3 (Hold) company have rallied 58.1% year to date, significantly outperforming the S&P 500’s 16.7% gain.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Amazon leaves no stone unturned to understand the evolving customer pattern. In this regard, the company has been accumulating data over the years to keep a tab on customers. It is therefore well positioned to cross promote products, drive deals on its platform, sell more Prime subscriptions and increase sales.

Performance of Other Retailers

In anticipation of a decline in footfall at brick-and-mortar stores, traditional retailers have been enhancing their websites, tightening inventories and ramping up delivery options. Interestingly their efforts have paid off well.

Kohl's (NYSE:KSS) declared that it had a "record-breaking" Thanksgiving day sales, both offline and online, with more than 126 million visits to kohls.com. On Black Friday, online orders that were picked up in stores, increased 40% year over year.

J. C. Penney (NYSE:JCP) also witnessed a double-digit increase in traffic on jcp.com last week. On Thanksgiving Day, it received the largest number of visits.

Macy's (NYSE:M) is said to have sold more than 1 million coats, fleece jackets and sweaters by the end of the week.

According to retail research firm ShopperTrak, store traffic fell less than 1% on Black Friday, narrower than industry predictions.

The National Retail Federation forecasted a strong holiday sale this year and we will have a clearer picture when it releases Thanksgiving, Black Friday and Cyber Monday sales numbers on Nov 28.

What’s Driving the Wheel?

Consumers are looking at convenience factors more than ever this year. Lower-priced goods, free shipping and product availability are the primary factors driving online shopping this season.

Strong economic indicators like record job data and declining unemployment rate are encouraging shoppers to spend more online. Per the Bureau of Labor Statistics, the domestic economy generated 261,000 new jobs in October, the highest so far in 2017. Also, the unemployment rate of 4.1% in the month is the lowest this year.

Impressive third-quarter results and record quarterly GDP numbers reflect the economy’s financial strength. Additionally, personal income increased by $66.9 billion or 0.4% in September, while disposable personal income that measures the total amount of money available for use after taxes rose by $73.6 billion, or 2.1%, in the third quarter, according to the Bureau of Economic Analysis.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Macy's Inc (M): Free Stock Analysis Report

J.C. Penney Company, Inc. Holding Company (JCP): Free Stock Analysis Report

Kohl's Corporation (KSS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Over the weekend I warned about the weakness in the Semiconductor sector (SMH). I also wrote about Granny Retail XRT, and how important it is for that sector to stay alive. Both...

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

More than a century ago, then-Representative William McKinley pursued an aggressive tariff strategy that sought to protect American industry and reduce reliance on foreign...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.