Allegheny Technologies Incorporated (NYSE:ATI) has provided its guidance for second quarter of 2017. The diversified specialty materials producer expects earnings in the band of 4–9 cents per share and revenues in the range of $865–$890 million for the quarter. The company also announced that it has extended Asset Based Lending (ABL) facility to Feb 2022 from Nov 2017.

Alleghany also expects corporate and closed operations expenses to increase roughly $10 million on sequential comparison basis in the second quarter.

The company said that the extension of the ABL facility, including the maturity of its term loan worth $100 million, will provide a liquidity cushion. As on date, Alleghany has no major debt maturities until Jun 2019.

Notably, Alleghany made commendable progress in repositioning and restructuring its Flat Rolled Products (“FRP”) business, but it remains alert in the short-term due to declining cost of raw materials, mainly nickel and ferrochrome. Considerable declines in the prices of raw material in the second quarter are unfavorably impacting transaction prices and surcharges, resulting in the FRP unit to be at or near breakeven in the second quarter.

However, the company noted that the second quarter performance is consistent with the outlook it provided in April. Furthermore, it expects the performance of the High Performance Materials and Components segment to improve in the quarter with sequentially higher operating margin.

The company also said that cash generation from operations remains a key focus as it continues manage working capital requirements carefully.

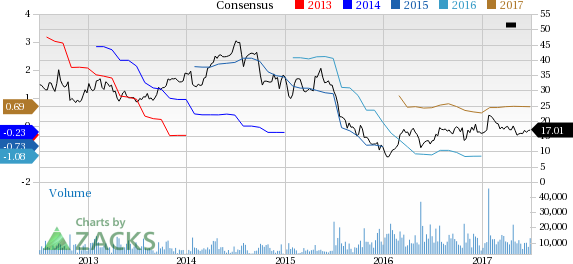

A look at Allegheny’s share price movement shows that the stock was down 2.9% in the last three months, underperforming the Zacks categorized Steel-Speciality industry’s decline of 1.1%.

Allegheny should benefit from its diversified global growth markets as well as cost reduction and restructuring measures, moving ahead. Also, the company is witnessing healthy demand from aerospace OEMs, buoyed by production ramp ups.

However, Alleghany remains exposed to certain challenges in its core FRP segment and facing an overcapacity of competitive stainless steel. Demand for its products in the oil and gas market is also expected to remain under pressure in the short haul.

Allegheny currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked companies in the basic materials space include The Sherwin-Williams Company (NYSE:SHW) , Hitachi Chemical Company, Ltd. HCHMY and The Chemours Company (NYSE:CC) . All the three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Sherwin-Williams has expected long-term earnings growth rate of 11.4%.

Hitachi Chemical has expected long-term earnings growth rate of 5%.

Chemours has expected long-term earnings growth rate of 15.5%.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Chemours Company (The) (CC): Free Stock Analysis Report

Sherwin-Williams Company (The) (SHW): Free Stock Analysis Report

Allegheny Technologies Incorporated (ATI): Free Stock Analysis Report

HITACHI CHEMICL (HCHMY): Free Stock Analysis Report

Original post

Zacks Investment Research