- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Alaska Airlines' Capacity Cuts To Widen Due To Corona Crisis

Alaska Air Group’s (NYSE:ALK) subsidiary Alaska Airlines will now reduce capacity by at least 10% in April and 15% in May as coronavirus concerns are on the rise. Previously, on Mar 10, management stated that it expects to trim capacity by approximately 3% in May. Ever since, passenger demand has persistently declined with significant increase in cancellations and extremely low new bookings.

Further, the airline will keep track of the demand status and if needed, will continue to lower capacity on a rolling 15-day basis. The carrier is also looking for additional borrowing of approximately $500 million.

Cost-Cutting Measures

Amid the downturn, the airline focuses on preserving cash by suspending at least $300 million of its capital spending, primarily by delaying pre-delivery aircraft payments and a few non-aircraft capital projects. The carrier will also suspend share repurchases. Moreover, it is freezing hiring, except for crucial front-line and management roles, and also offering employees unpaid leaves of absence for 30, 60 and 90-day time frames. Since Mar 7, the base salaries of the company’s CEO Brad Tilden and president Ben Minicucci have been reduced to zero.

Similar measures were taken by Delta Air Lines (NYSE:DAL) and United Airlines (NASDAQ:UAL) in the past.

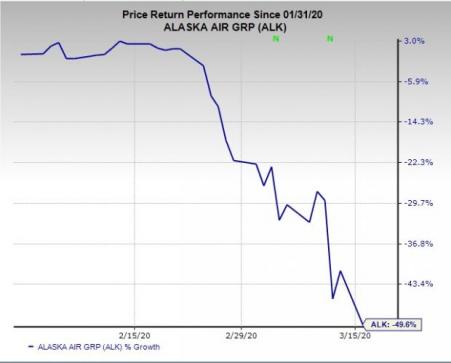

Shares of Alaska Airlines have plunged 49.6% since the beginning of February due to the demand slump caused by coronavirus.

Zacks Rank & Key Pick

Alaska Air Group carries a Zacks Rank #3 (Hold). A better-ranked stock in the same space is Azul (NYSE:AZUL) , sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Azul’s earnings surpassed the Zacks Consensus Estimate in each of the preceding four quarters, the average being 209%.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Delta Air Lines, Inc. (DAL): Free Stock Analysis Report

United Airlines Holdings Inc (UAL): Free Stock Analysis Report

Alaska Air Group, Inc. (ALK): Free Stock Analysis Report

AZUL SA (AZUL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.