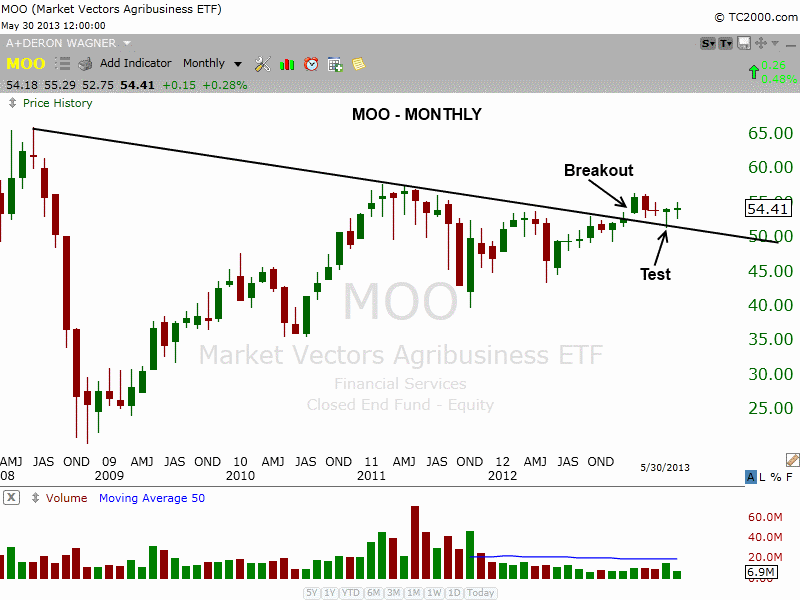

Although commodity-based stocks have been a big laggard this year, we have noticed some relative strength in Market Vectors Agribusiness (MOO). After breaking a long-term downtrend line and successfully testing that line last month, we could possibly see a breakout entry emerge down the road (if the price action remains in a tight range). MOO is not actionable now, but should be added to your radar screen as a potential buy entry. Here is the monthly chart:

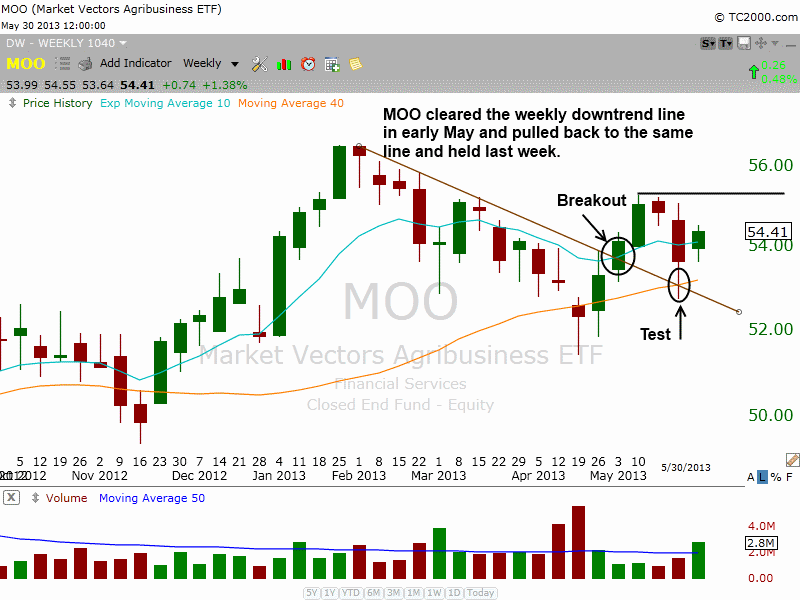

Dropping down to the weekly time interval, we see the 10-day MA (teal line) above the 40-week MA (orange line). Like the test of the downtrend line on the monthly chart above, we see the same below, with last week’s test of the downtrend line and the 40-week MA.

For this setup to remain constructive, the price action should hold above the 40-week MA and the higher “swing low.” It may take several weeks for the price to tighten up on the right hand side, so we will place MOO on a second tier watchlist (one that is reviewed only on the weekends):

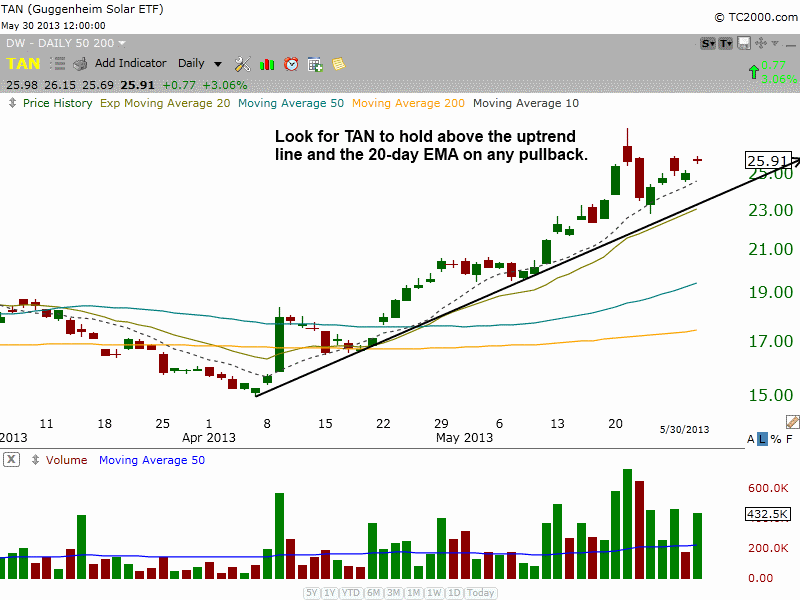

After finding support around the $23 area, Guggenheim Solar ETF (TAN) continues to push higher, above the rising 10-day MA. As you may recall from this, we’re holding a long position in this ETF (currently showing an unrealized gain of 10.5% since our May 23 pullback entry). The daily chart below details the support in TAN:

Should TAN fail to punch through the $26 level and pull back in (for a week or two), there is solid support from the uptrend line and the 20-day EMA around $23. Overall, this ETF continues to show great relative strength as the broad market consolidates.

In addition to TAN, we also bought Market Vectors Semiconductor ETF (SMH) when it pulled back on May 23. It too continues to act well, and closed yesterday right at resistance of its prior swing highs from mid-May. As such, we are selling partial share size on today’s open, just to lock in a decent gain on this short-term momentum trade. We will trail a protective stop higher on the remaining shares.

As mentioned earlier this week, our ETF scans have not produced much in the way actionable setups, so a short-term break in the market should eventually produce some low-risk buy points. Until then, we will simply remain patient and focus on managing existing positions.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Agriculture ETF Starts Sprouting, Solar ETF Continues To Shine

Published 06/02/2013, 04:51 AM

Updated 07/09/2023, 06:31 AM

Agriculture ETF Starts Sprouting, Solar ETF Continues To Shine

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.