- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Actuant Shuffles Energy Wing With Viking Sale, Mirage Buyout

Machinery company Actuant Corporation (NYSE:ATU) announced that it has successfully divested its Viking SeaTech business to Acteon Group Limited and acquired Mirage Machines, Ltd. from the same. Both these transactions were originally announced on Aug 16.

Viking SeaTech business was part of Actuant’s Energy segment and primarily delivered mooring solutions in the offshore oil & gas exploration, drilling and well development end markets. On the other hand, Mirage Machines manufactures industrial and energy maintenance tools.

Details of the Twin Transactions

As noted, the Viking SeaTech business generated roughly $20 million revenues in the trailing 12 months. Actuant received proceeds of approximately $12 million from Acteon for this divestment.

For Mirage Machines acquisition, the company paid roughly $16 million to Acteon and promised additional consideration based on future performance.

In fiscal 2017 (ended August 2017), Actuant recorded impairment and divestiture related charges of $117 million while predicts to incur $15-$20 million of these charges in second-quarter fiscal 2018.

Benefits From the Transactions

In fourth-quarter fiscal 2017, Actuant’s Energy segment’s sales totaled $68.6 million, decreasing 24.9% year over year. Core sales dipped 25% year over year. Poor upstream offshore oil & gas demand and lower sales accrued from the company’s Hydratight business, dented the segment’s sales in the quarter.

Actuant believes that both these transactions were in sync with its intention of streamlining its Energy business to provide superior benefits to shareholders. The Viking divestment will limit the company’s exposure to upstream, offshore oil & gas markets while the addition of Mirage Machines will broaden product offerings in the flange facing and hot tapping categories. Specifically, the buyout will complement the Energy segment’s Hydratight business and create rental and service business opportunities.

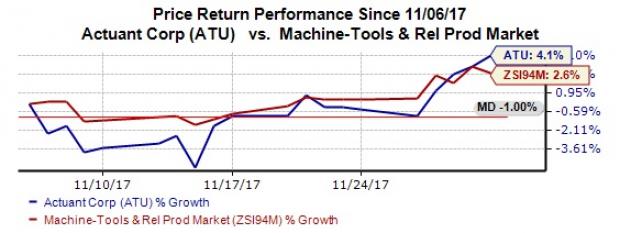

In a month, the company’s shares have yielded 4.1% return, outperforming 2.6% gain of the industry.

Zacks Rank & Other Stocks to Consider

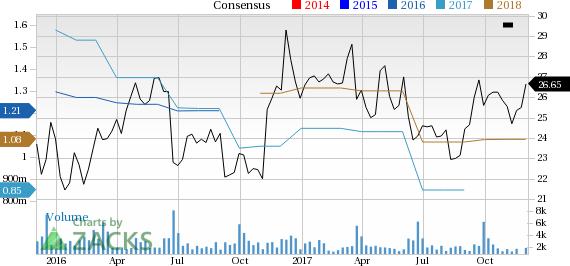

With a market capitalization of nearly $1.6 billion, Actuant currently carries a Zacks Rank #2 (Buy). The stock’s Zacks Consensus Estimate is currently pegged at $1.08 per share for fiscal 2018 (ending August 2018) and at $1.32 for fiscal 2019. These estimates represent year-over-year growth of 30.3% for fiscal 2018 and 22.2% for fiscal 2019.

Actuant Corporation Price and Consensus

Stanley Black & Decker, Inc. (SWK): Free Stock Analysis Report

Actuant Corporation (ATU): Free Stock Analysis Report

Kennametal Inc. (KMT): Free Stock Analysis Report

Altra Industrial Motion Corp. (AIMC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.