- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

AAR Corp (AIR) Misses Earnings And Revenue Estimates In Q2

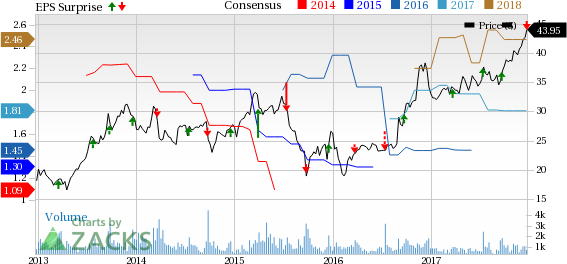

AAR Corp. (NYSE:AIR) reported second-quarter fiscal 2018 earnings of 35 cents per share, which missed the Zacks Consensus Estimate of 37 cents by 5.4. The bottom line remained in line with the year-ago figure.

Excluding one-time items, the company reported a loss of 66 cents in the reported quarter, as against earnings of 35 cents it generated in the prior-year quarter.

Total Revenues

Net sales came in at $449.7 million in the fiscal second quarter, which also missed the Zacks Consensus Estimate of $454 million by 1%. However, revenues increased 6.1% from $423.8 million in the year-ago quarter.

Segment Details

In the reported quarter, Aviation Services reported revenues of $391.6 million, up 13% year over year.

Expeditionary Services garnered revenues of $58.1 million, down 24.6% from $77.1 million in the year-ago quarter.

Highlights of the Release

In the fiscal second quarter, AAR Corp’s cost of sales increased 5.5% year over year to $377.2 million.

Selling, general and administrative expenses increased 12.7% to $52.2 million.

The company incurred interest expenses of $1.9 million, higher than $1.1 million in the year-ago quarter.

Financial Condition

As of Nov 30, 2017 AAR Corp’s cash and cash equivalents were $27.1 million, up from $10.3 million as of May 31, 2017.

As of Nov 30, 2017 net property, plant and equipment were $195.3 million compared with $201.9 million as of May 31, 2017.

As of Nov 30, 2017 total debt increased to $219.4 million from $159.3 million as of May 31, 2017.

Dividend History

During the reported quarter, the company paid dividends of $2.6 million or 7.5 cents per share.

Zacks Rank

AAR Corp currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Upcoming Peer Releases

Lockheed Martin Corp. (NYSE:LMT) is expected to report fourth-quarter 2017 results on Jan 23.

Raytheon Company (NYSE:RTN) is anticipated to report fourth-quarter 2017 results on Jan 25.

Spirit AeroSystems Holdings, Inc. (NYSE:SPR) is expected to report fourth-quarter 2017 results on Feb 7.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Lockheed Martin Corporation (LMT): Free Stock Analysis Report

AAR Corp. (AIR): Free Stock Analysis Report

Spirit Aerosystems Holdings, Inc. (SPR): Free Stock Analysis Report

Raytheon Company (RTN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

The S&P 500 had started to clear resistance, posting new all-time highs before sellers struck with a vengeance. The selling was bad, similar to that seen in December, which...

Myself and others have highlighted how European Equities have been breaking out to new all-time highs on the back of bullish factors such as cheap valuations, monetary tailwinds,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.