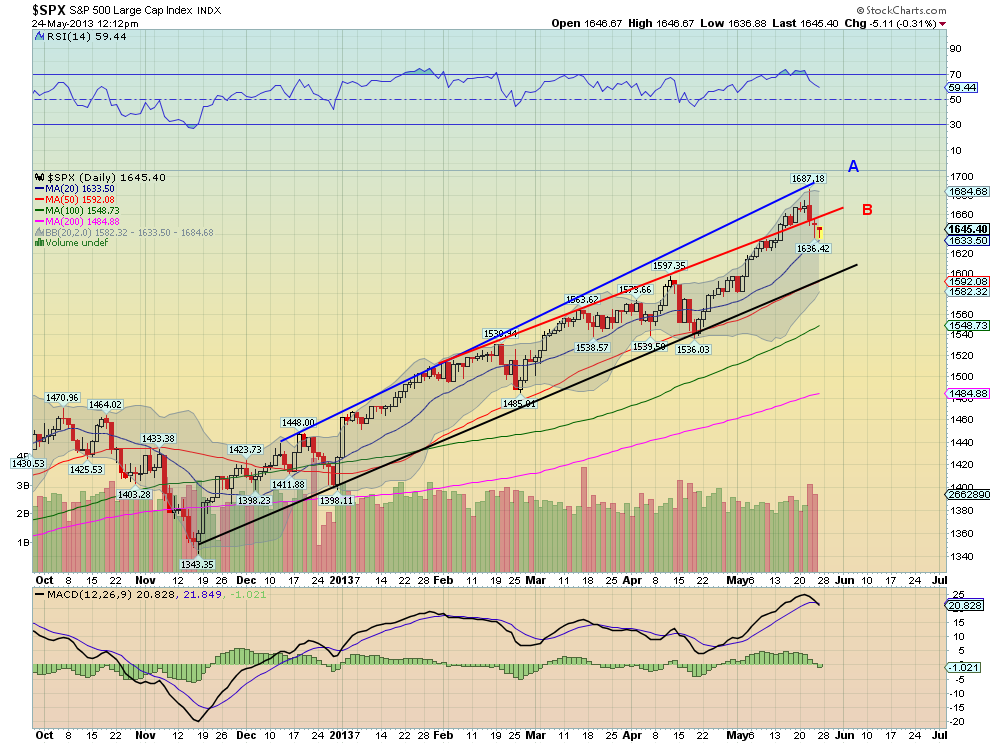

The chart below of the S&P 500 shows the rising trend since the low made November 16, 2012. There have since been many instances of top callers each time the RSI has reached the 70 level or the MACD started to roll flat and then lower. Each time rising trend support (black line) has held and the index has moved higher. Some think this time is different. My friend Ryan Detrick at Schaeffer’s noted that it may be different because of the break of the rising trend resistance and fall back. This argument chooses path B (the red line). It may be significant and certainly does carry some weight as this trend goes back to February 1, and it is parallel to the support trend. But looked a a little differently, using path A (blue line) the Index touched the top of the wedge and is falling back. A pullback at resistance.

Both views would take comfort in a hold again at the black support line, and if the Index gets under the 20 day SMA most on either path would be looking for that to happen. Is it important which line you pick? I say yes. It goes to your psychology, your sentiment. If you have been following the red line, this is a big failure and you are probably becoming more bearish. But if you are following the blue line then a good portion of your expected resistance sees this as a healthy pullback for now, no real change sentiment. So which one is right? There is no right answer. Technical Analysis is an art as well as a science, and the difference between the 2 levels is less that 1.5%. There is no certainty. I expect that bearish sentiment would rise because of these two views, but it will rise in a pullback anyway so how do you measure the difference? Try to keep your mind open to these nuances as you chart on your own. It is too bad that charting packages do not have fuzzy lines.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

A Or B You Decide – It Matters….Maybe

Published 05/24/2013, 02:00 AM

Updated 05/14/2017, 06:45 AM

A Or B You Decide – It Matters….Maybe

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.