With only a few hours to go before the FOMC rate decision, the U.S. dollar is trading quietly mixed against all of the major currencies.

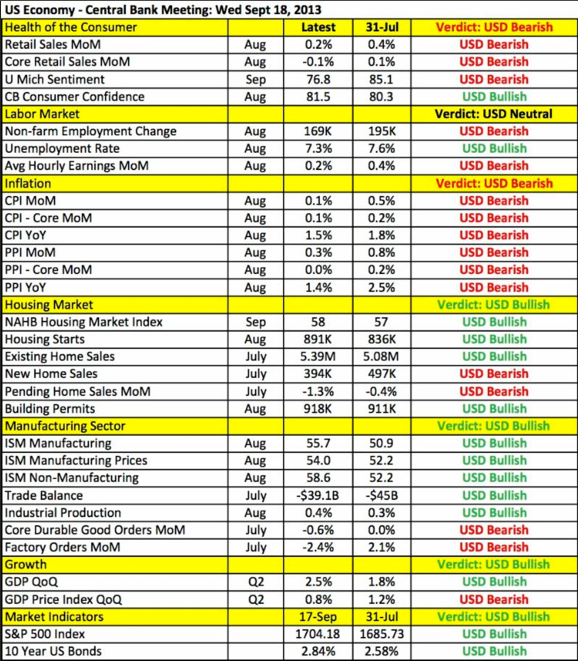

The last time the Federal Reserve held a monetary policy meeting was seven weeks ago and we have seen quite a bit of economic releases since then. There have been both improvements and deterioration but where it really counts (jobs and spending), the U.S. economy has weakened. As shown in the table below, retail sales growth had been sluggish since the beginning of the year but in August, core retail sales declined 0.1%. This retrenchment in spending was caused by weaker job growth and a decline in consumer confidence. The unemployment rate improved but unfortunately this was due to a drop in the participation rate and not an increase in job growth. The housing market seems to be performing better even with this morning's larger than expected drop in housing starts and building permits because the data is stronger than the June figures the central bank had on hand at the last meeting. The manufacturing and service sectors also experienced a stronger expansion last month. So it can be argued that amidst the weakness there is also strength and for the Federal Reserve, we believe there's enough momentum in the economy to justify less QE.

Jobs, Jobs, Jobs

Yet the main argument for a reduction in asset purchases is the unemployment rate. The Fed has put themselves into a very difficult position. Back in June Bernanke said the central bank will stop buying bonds and mortgage backed securities if the unemployment rate falls to 7%. The current level of unemployment is 7.3% and if the Fed were to end QE at 7%, they will need to start curbing their monthly bond purchases now. A reduction in Quantitative Easing should be positive for the dollar but investors can't assume that the dollar will automatically rally post FOMC. Strategically, the Fed will most likely strive to underwhelm, with the hopes of limiting any rise in yields, collapse in stocks and rally in the U.S. dollar.

Don't Count on the Dollar Rising Post FOMC

One of the most important jobs of a central bank is to minimize the volatility in the financial markets. Knowing that investors have waited with bated breath for this month's FOMC meeting, team Bernanke know that if they fail to manage the market's expectations properly, they risk triggering a sharp rise in volatility across the financial markets that could end up threatening the overall recovery. 24 hours before the FOMC announcement, U.S. 10 year yields are trading less than 15bp from 3%. Three percent yields is not the end of the world but the central bank would much rather this level be reached gradually than suddenly. The mere talk of tapering has already sent 10-yr yields up a full percentage point and this move was a shock to policymakers around the world. As a result, if the Fed reduces asset purchases tomorrow like we expect and they want to minimize the reaction, they will need to communicate clearly that tapering does not equal tightening and they stand ready to step up bond purchases again if the economy weakens.

There are a few ways they can manage down expectations:

How the Fed Could Manage Down Expectations

- Reduce asset purchases by $5 billion to $10 billion per month instead of $15 billion to $20 billion per month

- Cut Treasury purchases but leave MBS purchases intact to support the housing market

- Lower GDP and inflation forecasts (2016 forecasts will be unveiled)

- Reinforce forward guidance by saying that tapering does not increase the chance of tightening

- Express commitment to step up bond purchases if economy weakens

Knowing the risk that taper could have on long-term bond yields, we expect the Fed to choose all of the above which could adequately stave off an unfavorable reaction in the financial markets. Downplaying a decision to taper could also drive the U.S. dollar lower, which the central bank would be happy to see since a weaker currency supports the economy. A less likely but still viable option would be to delay the decision to December and if the Fed chooses to do so, we expect the dollar to sell-off quickly and aggressively. In terms of timing, the Fed's decision on tapering and their latest economic projections will be released at 2:00 pm ET/18 GMT. This will be followed by a press conference with Fed Chairman Ben Bernanke at 2:30pm ET/18:30 GMT.

Kathy Lien, Managing Director of FX Strategy for BK Asset Management