- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

A Close Call For Overbought Status

T2108 Status: 71.8% (low of the day was 69.2%)

T2107 Status: 42.7%

VIX Status: 16.2

General (Short-term) Trading Call: neutral

Active T2108 periods: Day #39 over 20%, Day #38 over 30%, Day #35 over 40%, Day #32 over 50%, Day #28 over 60%, Day #27 over 70% (overbought)

Commentary

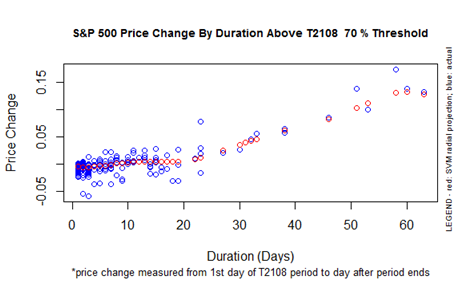

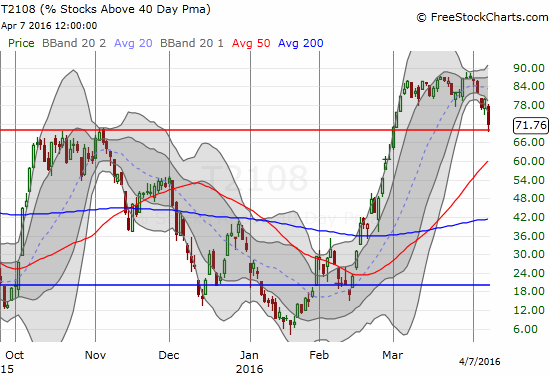

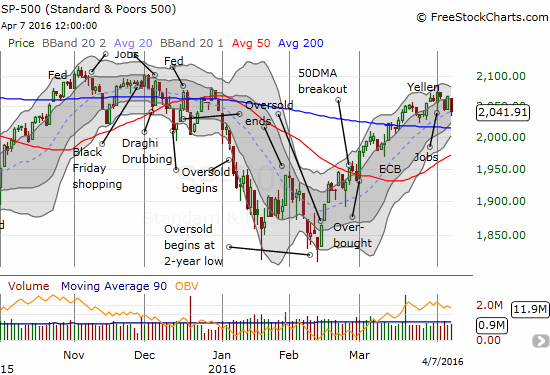

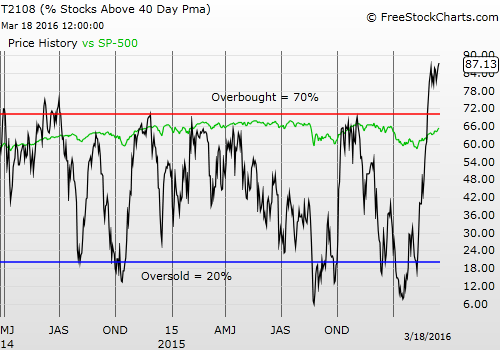

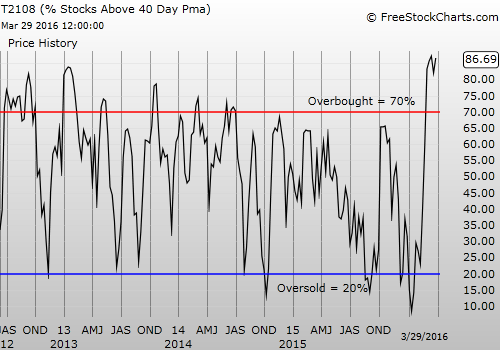

T2108, the percentage of stocks trading above their respective 40-day moving averages (DMAs) dropped as low as 69.2% before returning to overbought status for a 71.8% finish. That was a close call where I assumed that Thursday would be the day that ended this formerly impressive overbought period. My running assumption has been that T2108 would begin the run-up implied in the chart below. T2108 has now been overbought, above 70%, for 27 trading days. The S&P 500 has gained 3.2% during this overbought period. If the overbought period ends Friday, the duration vs performance will likely be closely consistent with historical patterns.

S&P 500 Performance By T2108 Duration Above the 70% Threshold

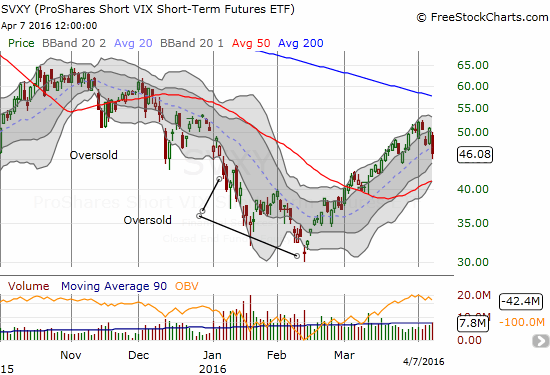

I discussed the scenarios between an immediate end to the overbought period vs a renewed run-up in Friday’s piece “Weighing the Prospects for a Fresh Market Lift-Off.” By Tuesday, April 5th, I revised my thinking to give the bearish case more consideration in “A Nervous Market Awaits More Fed Refreshments.” I allowed for some Fed-related boosts. Like clockwork, the Fed minutes helped the market refresh and revive. My trade going long on ProShares Short VIX Short-Term Futures (NYSE:SVXY) worked just about as well as I could expect. The market’s rally became so strong going into the release of the Fed minutes that I decided to lock in my profits ahead of the news. I lamented a bit leaving a half point or so on the table…until today’s subsequent sell-off.

ProShares Short VIX Short-Term Futures (SVXY) confirms the end of its primary uptrend by closing below its 20DMA.

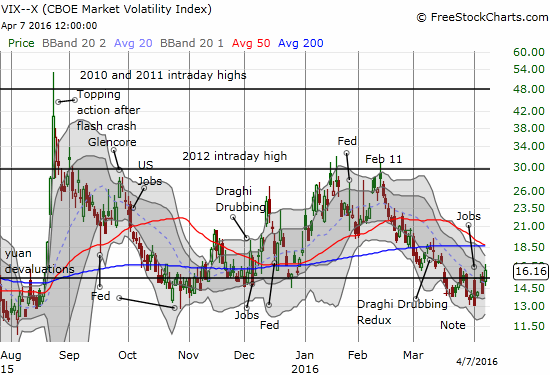

Danger zone! The VIX has suddenly popped back above the reliable 15.35 pivot….

Sticking to the Fed-based plan, I bought into this sell-off and accumulated fresh shares. The intraday selling was so strong that I decided to try quickly flipping call options on ProShares Ultra VIX Short-Term Futures (NYSE:UVXY)…and it worked well. Most bets are off if T2108 closes below 70% and ends this overbought period. I have learned from past history that the end of overbought periods can start a period of significant selling pressure. This behavior is partially why my revised T2108 trading rules dictate waiting out the overbought period before getting bearish. I am however prepared to stay flexible given the last overbought period was in the summer of 2014.

T2108 has quickly dropped from lofty to the borderline.

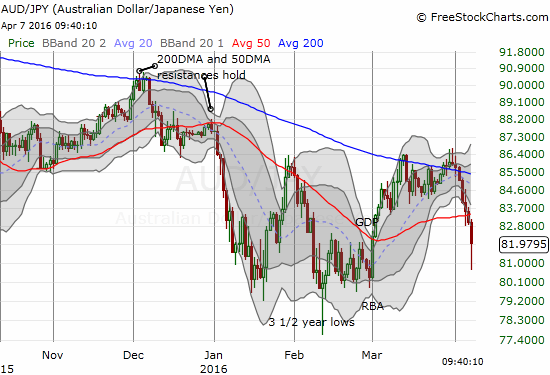

I am particularly concerned because the Japanese yen (NYSE:FXY) continues to strengthen. In trading yesterday, the yen got so extended that I finally closed out my short against the Australian dollar (NYSE:FXA) using the yen. (Earlier in the week I closed out my latest large short position on GBP/JPY). At the time of writing, I started right back into a fresh short position as Asian trading began with a bit of a relief rally on AUD/JPY.

AUD/JPY plunged well below its lower-Bollinger Band and almost reversed all its gains from March.

The last, lingering market positives are two-fold…

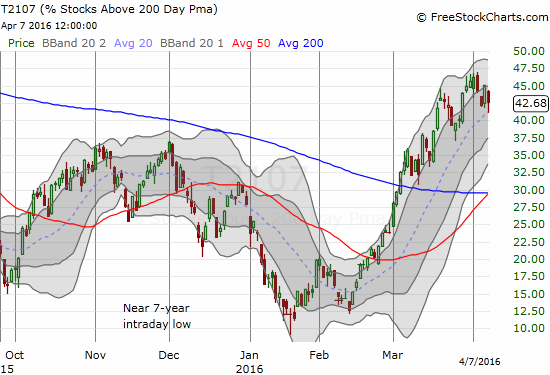

T2107, the percentage of stocks trading above their 200DMAs, has yet to experience a substantial setback…

Unlike T2108, T2107 has not suddenly reversed all its gains from March. T2107 remains within a somewhat stable range.

…and the S&P 500 (SPDR S&P 500 (NYSE:SPY)) closed on top of 20DMA support just above its 200DMA support.

The S&P 500 (SPY) can avoid fresh bearish tidings by holding onto nearby support levels at the 20DMA and definitely at the 200DMA.

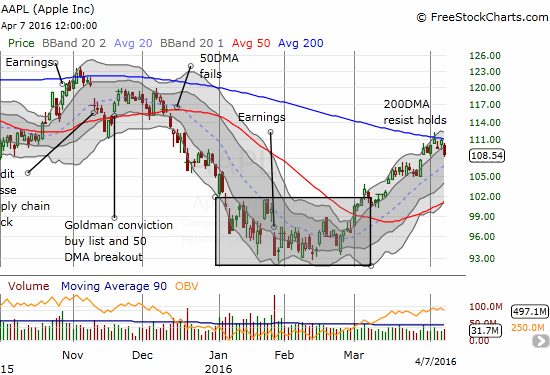

It looks like the market will lose an opportunity for an important victory from Apple (NASDAQ:AAPL). After the breakout shown below, AAPL steadily, stubbornly, and persistently rolled higher toward its 200DMA line of resistance. Thursday's selling unfortunately confirmed the failure of that test. AAPL will need a fresh catalyst, probably earnings, before it can do its part to help lift T2107.

Apple (AAPL) confirms 200DMA resistance with a 2.2% loss that puts the 20DMA and then the 50DMA in play for tests of support.

I will be almost on the edge of my seat for today's trading. I am disinclined to take SVXY through the weekend. I am looking to the meeting of Fed Heads this evening to generate some positive and soothing words for the market. Most importantly, I will be watching to see whether this week will close with the overbought period intact…it will be a close call.

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

Be careful out there!

Full disclosure: long SVXY, long USD/JPY, short AUD/JPY

Related Articles

If you can keep your emotions in check, the volatility in stocks sets up a long-term buying opportunity. However, investors with a lower risk tolerance may want to consider...

Let’s get right to it. First a quick comment on the weekly charts. The Russell 2000 (IWM) (Gramps) is at a key life support level on the 200-week moving average. Grandma...

While market cap weighting is still the go-to for many investors due to its low cost and low turnover, it's becoming increasingly fragile these days thanks to the concentration...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.