- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

6 Consumer Staple Stocks To Withstand Virus-Induced Disturbances

Wall Street continues to grapple with severe market volatility as the coronavirus pandemic is showing no signs of slowing down. Market participants have been left in the lurch with day-to-day fluctuations ranging from 5-7%.

However, a few consumer staple stocks with a favorable Zacks Rank have witnessed upward estimate revisions for 2020 earnings per share (EPS) during the past 30 days amid the coronavirus pandemic, which has been wreaking havoc on the global stock markets.

Notably, market mayhem and possibility of a near-term recession as warned by several economists and financial experts have also failed to deter these stocks. Investors can take a look at these stocks as these are likely to cushion their portfolio against market uncertainty.

Wall Street Witness Historic Rout

On Mar 16, the three major stock indexes — the Dow, the S&P 500 and the Nasdaq Composite — plummeted 12.9%, 12% and 12.3%, respectively. Notably, during the intraday session, a first-level circuit breaker is triggered when the S&P 500 drops by 7% resulting in a 15-minute pause in trading. Another halt happens when the benchmark index tumbles 13% on the day.

After Monday’s losses, the Dow is currently 31.7% below its all-time high. Meanwhile, the S&P 500 and the Nasdaq Composite are more than 29% below their all-time highs recorded last month. Notably, the Dow fell to its lowest point since 2017. Year to date, these indexes have lost 29.3%, 26.1% and 23.1%, respectively.

The COBE VIX — popularly known as the best fear gauge of Wall Street — surged 43% to record a new all-time high of 82.69, surpassing its previous peak level of 80.74 posted on Nov 21, 2008.

Why Consumer Staple Stocks

The consumer staples sector includes companies that provide necessities and products for daily use. This makes the sector defensive in nature. Thereore, this has always been a go-to place for investors, who want to play it safe during extreme market fluctuations. Adding stocks from the consumer staples basket lends more stability to portfolios in an uncertain market condition.

The stock market mayhem is likely to continue in the near term as the coronavirus is still spreading globally. This caused a significant disruption in global economic activities resulting in a global recession threat. At this critical stage, investment in consumer staple stocks will be prudent.

Our Top Picks

We have narrowed down our search to six consumer staple stocks that have witnessed strong EPS estimate revisions in the past month. Notably, the past month was the period when Wall Street witnessed one of the worst financial disasters in its history. Moreover, the stocks have solid growth potential and a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

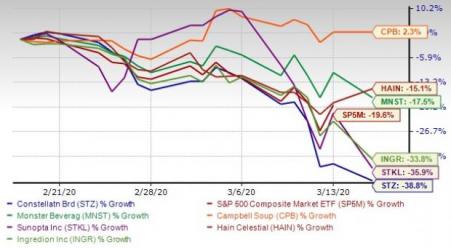

The chart below shows the price performance of our six picks in past month.

Monster Beverage Corp. (NASDAQ:MNST) develops, markets, sells, and distributes energy drink beverages and concentrates in the United States and internationally. It operates through three segments: Monster Energy Drinks, Strategic Brands and Other. The company has an expected earnings growth rate of 12.3% for the current year. The Zacks Consensus Estimate for the current year has improved 0.9% over the past 30 days.

Campbell Soup Co. (NYSE:CPB) manufactures and markets food and beverage products. It operates through Meals & Beverages and Snacks segments. The company has an expected earnings growth rate of 13% for the current year (ended July 2020). The Zacks Consensus Estimate for the current year has improved 2.8% over the past 30 days.

Constellation Brands Inc. (NYSE:STZ) produces, imports and markets beer, wine and spirits in the United States, Canada, Mexico, New Zealand and Italy. The company has an expected earnings growth rate of 4.8% for the current year (ended February 2021). The Zacks Consensus Estimate for the current year has improved 0.2% over the past 30 days.

SunOpta Inc. (NASDAQ:STKL) offers an integrated business models in the natural and organic food, supplements and health and beauty markets. The company has an expected earnings growth rate of 32.4% for the current year. The Zacks Consensus Estimate for the current year has improved 10.7% over the past 30 days.

The Hain Celestial Group Inc. (NASDAQ:HAIN) manufactures, markets, distributes and sells organic and natural products. It operates in seven segments: the United States, United Kingdom, Tilda, Ella's Kitchen UK, Canada, Europe and Hain Ventures. The company has an expected earnings growth rate of 7.8% for the current year (ended June 2020). The Zacks Consensus Estimate for the current year has improved 1.4% over the past 30 days.

Ingredion Inc. (NYSE:INGR) produces and sells starches and sweeteners for various industries. It operates through four segments: North America; South America; Asia Pacific; and Europe, Middle East, and Africa. The company has an expected earnings growth rate of 6% for the current year. The Zacks Consensus Estimate for the current year has improved 0.7% over the past 30 days.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

The Hain Celestial Group, Inc. (HAIN): Free Stock Analysis Report

Campbell Soup Company (CPB): Free Stock Analysis Report

Constellation Brands Inc (STZ): Free Stock Analysis Report

SunOpta, Inc. (STKL): Free Stock Analysis Report

Ingredion Incorporated (INGR): Free Stock Analysis Report

Monster Beverage Corporation (MNST): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The fortune of Nvidia (NASDAQ:NVDA) is closely tied to Big Tech hyperscalers. Although the AI/GPU designer didn’t name its largest clients in the latest 10-K filing on Wednesday,...

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

The United States is the largest exporter of liquefied natural gas (LNG), having surpassed Australia and Qatar in 2023. The United States exports an estimated 12.5 billion cubic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.