Shoppers have a free rein now after restricted spending in the third quarter. Official data show that retail sales picked up in September after a nominal decline in August. Surge in motor vehicle purchases and gas stations gains mostly helped revive sales.

All in all, 10 out of 13 major retail categories showed gains, with restaurants, furniture stores and building supply outlets showing solid increases. A combination of steady jobs growth, modest uptick in wages and an increase in household net worth laid the foundation for consumer spending. Hence, it will be prudent to add fundamentally sound stocks from the retail sector.

Sales at Car Dealers, Gas Stations Rise

Sales at U.S. retailers climbed the maximum in 3 months in September, a sign that consumers are spending enough to maintain economic growth at a slow but steady pace. According to the Commerce Department, retail sales jumped 0.6% in September following a revised 0.2% decline in August. Sales were up 2.7% from the year-ago levels.

An uptick in auto purchases and sales at gas stations particularly boosted overall sales. In September, sales at car dealers increased 1.1%, courtesy of high discounts. According to Ward’s Automotive Group data, purchases of cars and light trucks jumped to a 17.65 million at an annualized rate last month. Auto purchases more or less account for one-fifth of entire retail outlays.

Gasoline service stations registered a 2.4% pickup in receipts, reflecting the higher prices at the pump. Per Americans Automobile Association, cost of gasoline averaged $2.20 a gallon in September, more than $2.16 in August.

Broad-Based Gains, Apple iPhone Contribute

Eating and drinking establishments saw the highest rally in September since February, clocking a 0.8% gain. Receipts at sporting goods and hobby stores also rose 1.4%, indicating strong discretionary spending.

Sales at home furnishing outlets and building material suppliers stood out. Internet retailers also posted higher sales while the same at department stores took a hit. In the meantime, sales at miscellaneous retail establishments were up 1.8% buoyed by the release of Apple Inc.’s (NASDAQ:AAPL) iPhone 7. T-Mobile US, Inc. (NYSE:S) and Sprint Corporation (NYSE:S) confirmed last month that preorders for the model was about four times any other model (read more: Will iPhone 7 Push Apple Back to Bull Market Territory?).

Nonetheless, the so-called ‘core’ sales, which exclude autos, gas stations, food services and building materials, rose a modest 0.1%.

What Drove Spending?

Improvement in jobs growth and income levels helped boost sales at retail outlets to gain momentum last month. The economy added 156,000 jobs in September, an encouraging figure given that the U.S. has reached full employment levels.

A tighter labor market, meanwhile, compelled companies to pay higher wages to attract or retain employees. Hourly pay rose 0.2% to $25.79 in September. The average work week also inched up 0.1 hour to 34.4 hours. In fact, prior to September, personal income rose 0.2% in August, according to the Bureau of Economic Analysis.

Top 5 Retail Stocks to Buy Now

The aforementioned factors are expected to keep retail sales ticking up in the future as well. A gauge of consumer confidence level has also touched the highest level in nine years in September, a sign that households will continue to spend to support economic growth in the near term. Household spending surged 4.3% in the second quarter, the highest since the end of 2014.

As the future looks bright for the retail sector, thanks to September’s rebound, it will be a smart move to bet on stocks in the space. To top it, the National Retail Federation has already predicted that the upcoming holiday sales, excluding autos, gas, and restaurant sales, will increase 3.6%, which is “significantly higher” than the 10-year average of 2.5% (read more: 3 Reasons Why This Holiday Shopping Season Will Be Great).

We have selected five stocks from the retail sector that boast a Zacks Rank #1 (Strong Buy) or 2 (Buy). But, it is important to remember that picking winning stocks may not be easy. Hence, we have narrowed down our search with a VGM score of ‘A’. Here V stands for Value, G for Growth and M for Momentum and the score is a weighted combination of these three scores. Such a score allows you to eliminate the negative aspects of stocks and select winners.

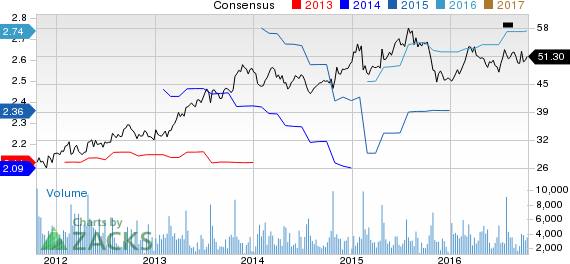

U.S. Auto Parts Network, Inc. (NYSE:S) operates as an online retailer of aftermarket auto parts and accessories, mainly in the United States. The company’s – a Zacks Rank #2 stock – estimated earnings growth rate for this year is 275%. U.S. Auto Parts Network has also been on an upward trend over the past 60 days, as estimates have risen from 5 cents/share to 7 cents right now.

US AUTO PARTS Price and Consensus

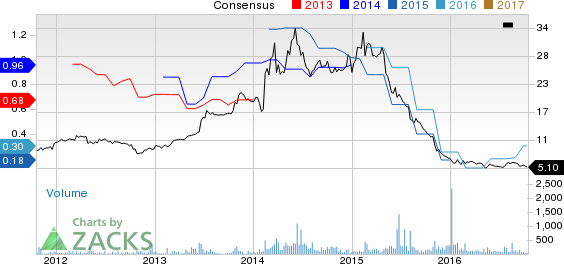

The Cheesecake Factory Incorporated (NASDAQ:CAKE) operates full-service and casual dining restaurants, primarily in the United States. Cheesecake Factory has a Zacks Rank #2. The company’s estimated earnings growth rate for this year is 15.5%. The company has also been on an upward trend over the past 60 days, as estimates have risen from $2.73/share to $2.74 at the moment.

CHEESECAKE FACT Price and Consensus

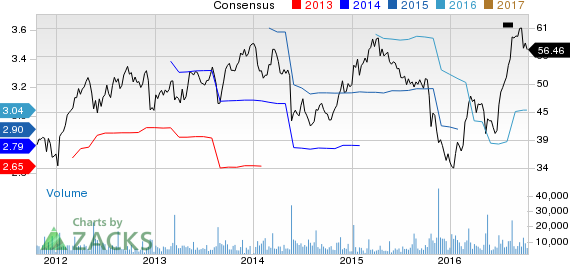

Famous Dave's of America Inc. (NASDAQ:DAVE) develops, owns, operates and franchises restaurants under the Famous Dave’s brand. The company’s estimated earnings growth rate for this year stands at a whopping 500%. Famous Dave's of America has also been on an upward trend, as estimates have risen from 20 cents/share two months ago to 30 cents right now. The company carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

FAMOUS DAVES Price and Consensus

Dick's Sporting Goods Inc. (NYSE:S) operates as a sporting goods retailer primarily in the eastern United States. The company has a Zacks Rank #1. Dick's Sporting’s estimated earnings growth rate for this year is 5.9%. The company has also been on an upward trend over the past 60 days, as estimates have risen from $2.84/share to $3.04 right now.

DICKS SPRTG GDS Price and Consensus

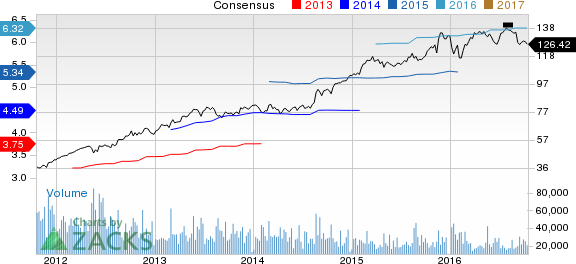

The Home Depot, Inc. (NYSE:HD) operates as a home improvement retailer. The company’s – a Zacks Rank #2 stock – estimated earnings growth rate for this year is pegged at 17.3%. Over the past 60 days, the company has seen estimates rise from $6.29/share to the current $6.32.

HOME DEPOT Price and Consensus

Looking for Ideas with Even Greater Upside?

Today's investment ideas are short-term, directly based on our proven 1 to 3 month indicator. In addition, I invite you to consider our long-term opportunities. These rare trades look to start fast with strong Zacks Ranks, but carry through with double and triple-digit profit potential. Starting now, you can look inside our home run, value, and stocks under $10 portfolios, plus more. Click here for a peek at this private information>>

SPRINT CORP (S): Free Stock Analysis Report

US AUTO PARTS (PRTS): Free Stock Analysis Report

HOME DEPOT (HD): Free Stock Analysis Report

APPLE INC (AAPL): Free Stock Analysis Report

CHEESECAKE FACT (CAKE): Free Stock Analysis Report

FAMOUS DAVES (DAVE): Free Stock Analysis Report

DICKS SPRTG GDS (DKS): Free Stock Analysis Report

T-MOBILE US INC (TMUS): Free Stock Analysis Report

Original post

Zacks Investment Research